Latest Post | Last 10 Posts | Archives

Previous Post: Open thread

Next Post: Let’s be careful out there

Posted in:

…Adding… Very handy links…

* Full budget briefing [Fixed file]

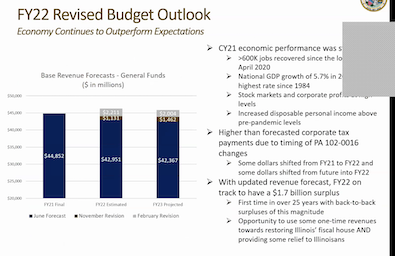

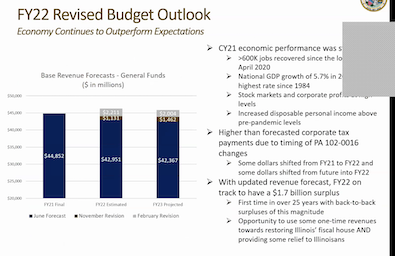

* The governor’s office has taken the embargo off of this morning’s budget briefing. They’ve revised the surplus upward for this fiscal year and next…

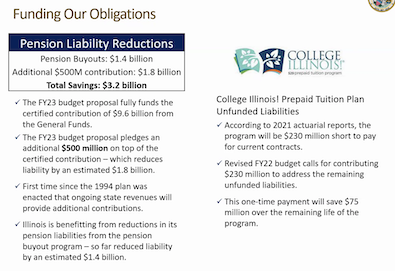

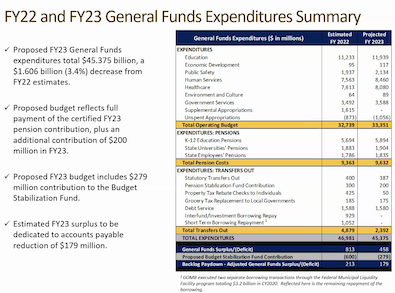

* As I told subscribers earlier, this is huge. An extra $500 million will be put into the pension systems…

* More…

* There was a problem with the screen earlier, so these are from yesterday’s briefing that I shared with subscribers…

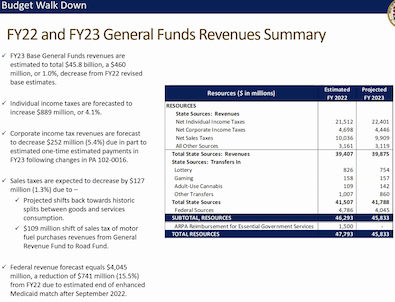

* Revenues and spending…

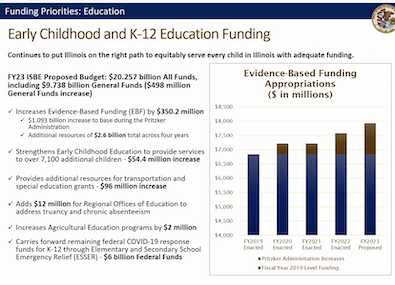

* Education…

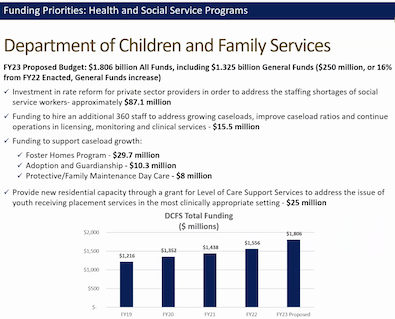

* DCFS…

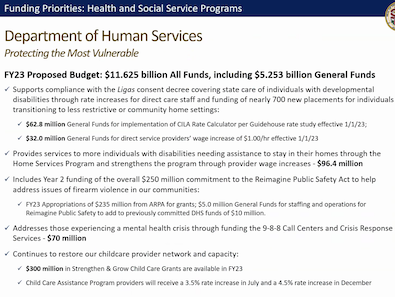

* DHS…

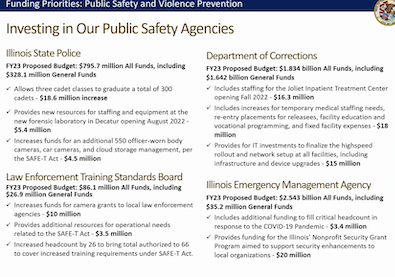

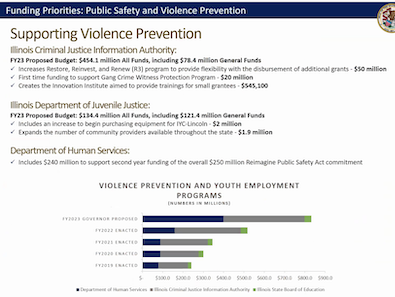

* Public safety and violence prevention…

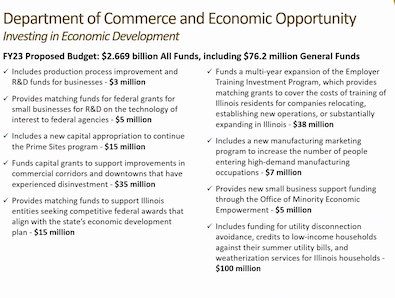

* DCEO…

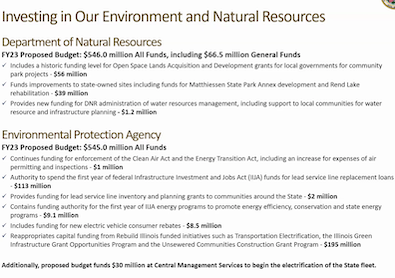

* IDNR and IEPA…

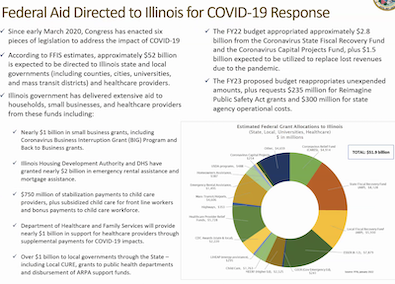

* Covid money…

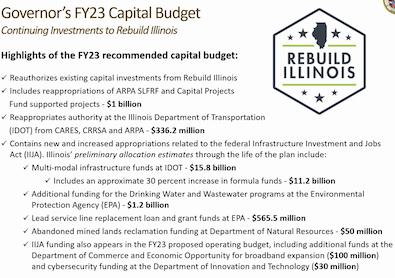

* Capital…

I missed some stuff, but hopefully I’ll be able to link to a briefing book.

* Question about surpluses…

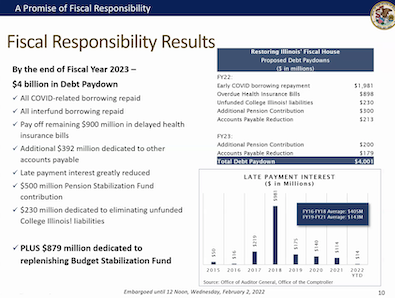

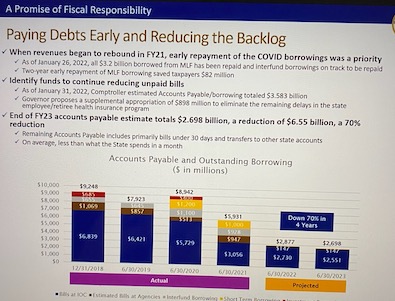

The surplus that we’re on track for in FY 22 is $1.7 billion, that is what is going to then be directed into some of our debt pay-down or Budget Stabilization Fund, and then a part of the tax relief proposal. The the surplus that’s left is the number that’s going into the accounts payable reduction.

* Any change in income tax revenue sharing with local governments? No.

* What about the unemployment insurance trust fund? Negotiations still ongoing through agreed bill process. Planning legislation by April adjournment.

* What percent of homeowners would see property tax relief? About 2 million people claim the income tax credit.

* Can you point to something that repairs a structural budget imbalance? Key part is aligning revenues with expenditures. The $500 million extra pension infusion will get the state funds to the “tread water” point, so that funding is actually paying down the debt. The massive state employee/retiree group health insurance backlog of nearly $900 million that has been around for years will be paid off if the budget is enacted.

* Do you have a Plan B for how to give drivers relief if Local 150 ends up killing your gas tax proposal? Long answer short: Not that I could discern.

posted by Rich Miller

Wednesday, Feb 2, 22 @ 9:14 am

Sorry, comments are closed at this time.

Previous Post: Open thread

Next Post: Let’s be careful out there

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

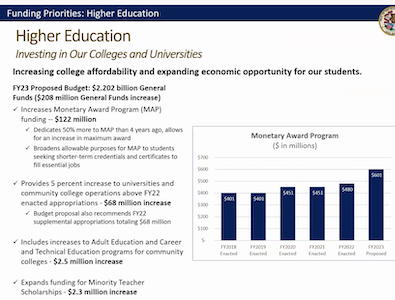

What is the governor is proposing to spend on Higher Education.

Comment by Bruce Rauner Wednesday, Feb 2, 22 @ 9:25 am

It’s interesting that the Governor is proposing a record amount of spending for OSLAD grants at IDNR, while at the same time IDNR is pushing legislation to eliminate the advisory board that gives input into the program.

Comment by SKI Wednesday, Feb 2, 22 @ 9:39 am

=while at the same time IDNR is pushing legislation to eliminate the advisory board=

Per IDNR comms office - the current language in that bill is “placeholder language” to get bill filed in time and is planning via amendment to keep NRAB. Sort of a overhaul of the 25 year old statute that created it. Will be interesting to see how that all sorts out.

Comment by DownSouth Wednesday, Feb 2, 22 @ 9:47 am

Given all the focus on paying down debts, will they still be able to maintain capital spending without having to issue billions in new debt? Sufficient funding from tax revenue/feds?

Comment by natty lite Wednesday, Feb 2, 22 @ 9:52 am

Looks like the agency briefings shown in the briefing book are just for the Governor’s agencies. Anything on non-Governor’s offices including the Constitutionals?

Comment by NonAFSCMEStateEmployeeFromChatham Wednesday, Feb 2, 22 @ 9:55 am

Rich - andy HFS or IDOA slides? thanks

Comment by macho man snowmania Wednesday, Feb 2, 22 @ 10:05 am

==What percent of homeowners would see property tax relief? About 2 million people claim the income tax credit.==

Another question: Will you give Renters some relief too?

Comment by NonAFSCMEStateEmployeeFromChatham Wednesday, Feb 2, 22 @ 10:09 am

=== Will you give Renters some relief too?===

Renters got relief during Covid, if needed and applied for, granted even that lagged behind… but this is a nod to owners.

Comment by Oswego Willy Wednesday, Feb 2, 22 @ 10:11 am

Paying down debt… under a Democratic administration. Amazing. Great job.

Comment by low level Wednesday, Feb 2, 22 @ 10:28 am

Thank you a lot Rich. While this level of budget analysis is way beyond my abilities, all I can understand does suggest we are moving in a very good direction, and with all deliberate speed. Thanks for providing this level of detail that I can at least mostly understand.

As to renters? Renters do not pay property taxes.

As to Bruce Rauner above? Read the tables. 2.2 B, about 200 M more this coming year, and a ton more that Bruce Rauner spend when he stole 100s of millions from each state university.

Comment by H-W Wednesday, Feb 2, 22 @ 10:31 am

Good news from the old Illinois Capitol

Comment by Rabid Wednesday, Feb 2, 22 @ 10:35 am

Folks, the whole slide deck is in his first PDF link, “Full Budget Briefing”.

Comment by Shark Sandwich Wednesday, Feb 2, 22 @ 10:39 am

“tax relief” is a gimmick that voters will not feel. Gas prices are up 40%+ in a year and this is only freezing a $0.02 increase thus no one will notice. The $300 in property tax relief is a transfer payment for Chicago homeowners. Chicago recently indexed annual property tax increases to CPI capped at 5% and there’s a lot of gripe around the reassessment. The $300 in relief will be transferred to city government and won’t cover the size of the increase people will see this year and next year. The grocery tax break is nice but on a $150 grocery bill you are looking at maybe $5 per trip but 7% inflation still means grocery bills are higher YoY. Increasing the LGDF levels or putting that $1Bn towards pensions would be smarter for the long-term fiscal health of voters and the State.

Comment by 1st Ward Wednesday, Feb 2, 22 @ 10:46 am

Is the property tax relief just basically a doubling of what is currently allowed for the annual tax credit? That’s how it reads to me. If so, that really doesn’t make much of a dent. Would be nice if sometime the state indexes property tax credits to a percentage of the property taxes paid for school districts. As the school funding formula matures and the state gets nearer to meeting the constitutional funding requirements for districts, it would be nice to start seeing some kind of break for what is the largest percentage of most folks’ property tax bills.

Comment by Anon221 Wednesday, Feb 2, 22 @ 10:52 am

===thus no one will notice===

They will if he puts a few million behind TV ads touting them.

Look, I don’t disagree. But it’s not designed to solve all problems. Only the feds have enough money for that.

Comment by Rich Miller Wednesday, Feb 2, 22 @ 10:53 am

===just basically a doubling of what is currently allowed===

Yes.

Comment by Rich Miller Wednesday, Feb 2, 22 @ 10:55 am

Really good news. Hats off to Gov. P and the Dem majorities in the House and Senate and, especially, to the taxpayers of the great state of Illinois. (smiling emojis)

Comment by froganon Wednesday, Feb 2, 22 @ 10:56 am

Would love to see the property tax credit also be refundable as many seniors do not have taxable income. Since no taxes paid then the credit is meaningless.

Comment by illinifan Wednesday, Feb 2, 22 @ 11:03 am

Did anyone notice that the Department of Juvenile Justice wants $134 million for the approximately 100 kids in state custody?

Comment by Confused Wednesday, Feb 2, 22 @ 11:34 am

=Chicago recently indexed annual property tax increases to CPI capped at 5% and there’s a lot of gripe around the reassessment.=

It is called PTELL

Comment by JS Mill Wednesday, Feb 2, 22 @ 11:39 am

Renters DO pay property taxes. Landlords consider the cost of property taxes when they determine the amount of rent they charge like all costs of ownership considered in determining the rental price.

Comment by jimbo26 Wednesday, Feb 2, 22 @ 11:45 am

Balancing budgets. Paying down debt. Paying down long-term liabilities like pensions. I know things can go south very quickly and change projections but when was it exactly that the Dems became the party of fiscal responsibility? Clearly the previous administration was not fiscally responsible. Actually, I don’t care when it was but if this budget holds, don’t we have to get another credit upgrade?

Comment by One Trick Pony Wednesday, Feb 2, 22 @ 11:49 am

==“tax relief” is a gimmick==

So was the Field of Dreams game. Everyone still loved it.

Cope if you must, but gimmicks often work.

Comment by Arsenal Wednesday, Feb 2, 22 @ 11:54 am

Back of the envelope, but I have the DCFS approp about $300M below the fiscal 03 budget. Have not done the higher ed lines yet, but those have been off for a loooooooong time.

This is still one of the better budget proposals. Amazing news about group insurance, pension contribution. Anxious to see what Approps do with it in Leader Harris’ last session.

Comment by Dirty Red Wednesday, Feb 2, 22 @ 12:01 pm

==actually hats off to President XI since without his virus none of this would be happening ==

Setting aside the tin foil hattery of “CHINA DELIBERATELY CAUSED THE VIRUS”, the fact is that the massive financial stimulus the federal government pumped into states was a deliberate policy choice, one that a lot of nations didn’t make. So if you want to argue that IL’s good budgetary news is solely due to federal stimulus, you’ll have to doff your cap to Nancy Pelosi.

But of course, you’ll find that unsatisfying.

So let’s return to the state level and note that getting a lump sum of money is one thing, spending it wisely is another. Again, choices were made, and had those choices not worked, Pritzker would have most assuredly taken the blame. Fair’s fair.

Comment by Arsenal Wednesday, Feb 2, 22 @ 12:01 pm

There’s quite a few local governments spending that federal COVID-19 like people spent their $1,800.

Some of those local governments are going to have an awkward moment or two when more attention has been directed to how they’ve been spending it or “giving it away” to pet projects or pet organizations.

Comment by Candy Dogood Wednesday, Feb 2, 22 @ 12:42 pm

=== “tax relief” is a gimmick ===

LOL. GOP politicians certainly don’t engage in gimmicks. /s

Comment by Norseman Wednesday, Feb 2, 22 @ 12:44 pm

@Jimbo26 - I stand corrected. And at the same time, landlords are almost certainly not going to lower rents if they in fact do pay lower taxes on their rental properties.

I wonder how this will affect school funding at the local level.

Comment by H-W Wednesday, Feb 2, 22 @ 1:05 pm

==“tax relief” is a gimmick==

So was the Field of Dreams game.==

So was Disco Demolition Night (and we all know how that turned out).

Comment by NonAFSCMEStateEmployeeFromChatham Wednesday, Feb 2, 22 @ 2:12 pm

I’d love tax relief if the state weren’t in such a pension and debt mess. Rather than a blatantly political tax cut for electoral purposes, he should use the money to pay off debt. It is entertaining, though, to read of the GOP criticisms of proposed tax cuts.

Comment by chitruth Wednesday, Feb 2, 22 @ 4:07 pm

Illinifan right: Property Tax thing will only benefit certain folks.

Comment by Joe Wednesday, Feb 2, 22 @ 9:41 pm