Latest Post | Last 10 Posts | Archives

Previous Post: Here’s How To Make The Tax Credit Scholarship Better

Next Post: It’s just a bill

Posted in:

* Keep in mind when reading this report from the legislature’s Commission on Government Forecasting and Accountability that total General Funds revenues had been projected to decline 2.9 percent this fiscal year. To date, General Funds revenues are up 3.8 percent over where they were as of the October, 2022 report. That doesn’t mean they’ll hold at that level. They could still decrease or even increase. But it’s still a big swing so far…

Through the first third of the fiscal year, total General Funds receipts are up $611 million. From a base revenue perspective, when accounting for both the removal of $764 million in one-time revenues from last year’s ARPA reimbursements and this month’s $633 million in one-time delayed federal matching funds, “base” revenues are up a net $742 million through October.

Personal Income Taxes are up $624 million so far this fiscal year, or +$516 million on a net basis. Corporate Income Taxes, however, are down slightly on both a gross basis [-$28 million] and a net basis [-$13 million]. Sales Taxes have risen $98 million through the first four months of FY 2024 [+$56 million net].

All Other State Sources are collectively $154 million higher through October. This is mainly due to the $153 million increase in Interest on State Funds and Investments. In addition, as mentioned previously, the Inheritance Tax is outpacing last year’s levels with a year-to-date increase of $44 million. Insurance Taxes are also $13 million higher. The growth in these areas have offset losses from several other State sources, including Other Sources [-$24 million]; the Public Utility Tax [-$22 million]; the Cigarette Tax [-$9 million]; and the Liquor Tax [-$1 million].

The category of Transfers In will be a volatile category throughout the year due to the timing of transfers into the State’s General Funds. After last month’s Income Tax Refund Fund transfer, receipts for this category were up a combined $233 million through September. However, when accounting for October’s activity and the lack of transfers this month from both the Income Tax Refund Fund and Gaming, the growth turns into a year-to-date combined deficit of $5 million. This is despite the $85 million rise in Lottery Transfers through October. This spread will worsen throughout the year, particularly in January, once the remaining $987 million from last year’s Income Tax Refund Fund enters into the equation.

Despite the $531 million rise in Federal Sources this month, overall federal dollars are still $96 million lower than last year through October. This is because the FY 2023 four-month totals include $764 million in one-time ARPA reimbursements that did not repeat in FY 2024. From a Federal Sources base perspective, if these one-time ARPA revenues are removed from the equation, along with the $633 million in prior-year federal matching funds receipted in October, year-to-date base growth for Federal Sources is +$35 million (as shown in the following table).

* There’s also some good news in the monthly data. The state was able to pry $633 million from the feds after missing out on the money earlier in the decade…

In August 2023, it was announced that, after a comprehensive internal review of federal revenue reimbursements in the State’s Medicaid related programs, the Illinois Department of Human Services and the Department of Healthcare and Family Services identified a computer programming error that led to incomplete federal Medicaid match claims for service dates between the end of 2020 and June 2022. The State was able to retroactively submit claims for this period of activity, resulting in a “one-time” federal match deposit of approximately $633 million in October. While this money would have been part of previous fiscal years’ General Funds “base” total if not delayed, for the purpose of evaluating FY 2024’s overall revenue performance, the Commission will separate these funds from “base” federal source dollars in its revenue tables. With this adjustment, “base” federal dollars actually fell $102 million in October.

Base federal dollars have been projected to rise by $269 million by the end of the fiscal year.

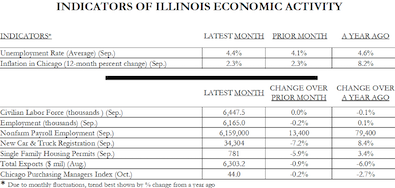

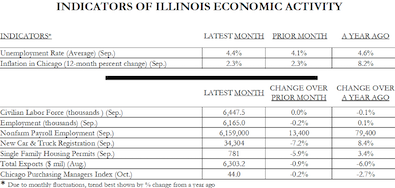

* COGFA chart…

The Chicago Purchasing Managers’ Index is explained here.

posted by Rich Miller

Friday, Nov 3, 23 @ 11:36 am

Sorry, comments are closed at this time.

Previous Post: Here’s How To Make The Tax Credit Scholarship Better

Next Post: It’s just a bill

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

More “sky is falling” predictions proving to be false. Maybe there will be extra money for Chicago’s migrant crisis, after all.

Comment by supplied_demand Friday, Nov 3, 23 @ 11:49 am

The increase in Single-Family Housing permits over last year is interesting as most national indicators and news sources have said that new housing has been down all year from last year. And last year was down significantly from the year before that.

Hopefully, that’s a good sign that housing is coming back.

Comment by Frida's boss Friday, Nov 3, 23 @ 12:07 pm

As the new manufacturing plants and entertainment centers (i.e. Chicago casino permanent site) open, that can only help the revenue situation. Lots of good to look forward to, pending the national situation and if “you know who” becomes president.

Comment by Grandson of Man Friday, Nov 3, 23 @ 12:18 pm

As much as I approve of the improvement in the fiscal condition, rather than put more $$ into rainy day fund, pay down pension debt, please.

Comment by Anyone Remember Friday, Nov 3, 23 @ 12:24 pm

==rather than put more $$ into rainy day fund, pay down pension debt, please.==

No reason we can’t continue doing both.

Comment by supplied_demand Friday, Nov 3, 23 @ 1:38 pm

–the Inheritance Tax is outpacing last year’s levels with a year-to-date increase of $44 million.–

Except that Illinois doesn’t have an Inheritance Tax. It has an Estate Tax…?

Comment by Curious Friday, Nov 3, 23 @ 1:40 pm

That’s pretty good, especially considering the tax only kicks in at the $4 million level.

Comment by RNUG Friday, Nov 3, 23 @ 3:25 pm