Capitol Fax.com - Your Illinois News Radar

Latest Post |

Last 10 Posts |

Archives

Previous Post: Caption contest!

Next Post: Question of the day

Do better

Posted in:

* When it comes to the pension issue, Chicago is chock full of reporters who are uninformed, gullible and even outright hostile. Before we begin, let’s take another look at this…

SECTION 5. PENSION AND RETIREMENT RIGHTS Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired. (Source: Illinois Constitution.)

* OK, now let’s move on to this weird report from WBBM Radio…

Illinoisans have heard for decades about how bad the state is at funding its pensions for public employees, and now, a new organization is working to make that easier for the public to see.

Katie Dunne is the executive director of Secure Illinois Retirements (SIR), which was launched last week. She said the nonprofit aims to be a resource for teachers, firefighters and other public employees. One way to do that is through SIR’s interactive tool.

“[It] allows visitors to find comprehensive information about their specific fund,” Dunne said.

The tool’s available for anyone to use. It shows, for example, how a treatment plant operator — who worked at the Metropolitan Water Reclamation District for 34 years before retiring — is only collecting about $38,000 of his $66,000 annual promised pension.

“It’s a true example of a public sector worker in that fund, and then we just had some fun and changed the names,” Dunne said. “So that is a pretty accurate view of where each of the funds are at.”

Emphasis added to highlight the complete falsity of that claim. If you were supposed to receive a $66,000 annual public pension in Illinois, you’re currently receiving $66,000.

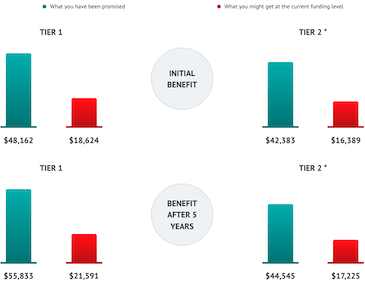

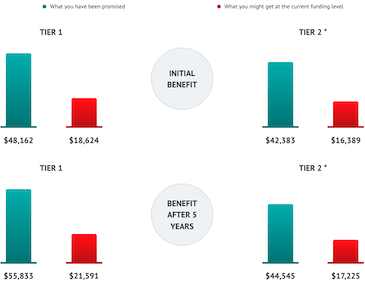

* To my eyes, the Secure Illinois Retirements website appears designed to scare pension recipients. This part of the site is what appeared to trip up WBBM…

The State Employees’ Retirement System of Illinois is only 38.67% funded* so let’s imagine that means you would receive only 38% of your promised benefits. If the funded status of your retirement system determined the amount of your pension, then this is the kind of situation you could be facing:

“Let’s imagine.” Ugh. This is a totally made-up scenario. The reality is that the funded status of a retirement system does NOT determine the amount of anyone’s pensions. Pensions have to be paid, whatever these people might ask you to “imagine.”

* If that reporter had simply scrolled down further, there was this buried disclaimer…

+ Disclaimer: The numbers displayed in the graph are intended for illustrative purposes only and should not be considered as accurate data. These are projections used to help visualize the current pension system funding levels. Therefore, they should not be used for any analytical or decision-making purposes. Please consult your local pension board for more in-depth information about your specific fund.

The funded ratio of your retirement system will not directly correlate with the portion of your pension you end up receiving.

The likely scenario is that everybody will get their full benefits for as long as the fund is solvent. When a fund becomes insolvent, your retirement is in peril.

When a fund becomes insolvent, the state constitution demands that the government must appropriate the money to at least fund annual pension payments, which the state already does. The state can’t declare bankruptcy. Municipalities can only declare bankruptcy with state permission.

* I asked this group multiple times several days ago where their funding was coming from and what they wanted. I received no response to the funding source question, but here’s part of their response…

Our organization has a simple mission: To educate public sector workers about the pension system and convene discussions about how to begin to move towards a fully funded system. There are many reputable sources and experts out there, but also those who seek to politicize or spread misinformation.

Yeah, well, intentionally or not, their group helped spread information on one of the top radio stations in the region.

The state pension ramp and local pension ramps (including first responders and Chicago) are a process over multiple decades. People look at unfunded liability increases even after billions in government payments and conclude that the state will never get ahead (click here for an example). They should take out their mortgage books and see how it actually works. There will come a time when we catch up, but, in the state’s case, the end is not until 2045 because the payoff was put on a 50-year, back-loaded schedule. For the past few years, pension payments have held to about 20 percent of state spending. That’s high, but sustainable.

* The Chicago first responder funds are most worrisome because they were neglected for so many years. The city was granted a casino license to boost payments. But let’s hope the previous mayor didn’t totally botch the deal or taxes will have to rise even further…

Bally’s Corp. says its chief financial officer’s statement that the gambling company intends to “right-size” its Chicago casino is not an indication the company has decided to reduce or otherwise alter the size of its much-anticipated venue here.

“The comments on our earnings call earlier today reference the opportunity relative to the size of the addressable market and our project scope, which we have never wavered upon,” Christopher Jewett, Bally’s senior vice president of corporate development, told Crain’s in an email. […]

Despite Bally’s statements, the company continues to post mixed financial results, with revenues in the last quarter increasing from $552 million to $606 million compared to 2022, but with the company reporting a net loss of $25.6 million in the latest period. The company also reported $3.31 billion in net long-term debt, with the Chicago casino and entertainment complex projected to cost $1.7 billion. […]

Asked on Thursday’s analyst call how Bally’s will finance the remainder of the $1.7 billion, Bally’s treasurer said the company is “looking at, you know, different forms of financing,” with Glover saying the company is “exploring all options.”

But if you think that this mayor, a former CTU official, is gonna cut off pensioners (even police pensioners), you might want to think again.

…Adding… Katie Dunne at Secure Illinois Retirements…

Secure Illinois Retirements is led by an all-volunteer board, who are retired/current public sector workers from across the state, including union members who serve as teachers, firefighters, and police. As previously shared, we believe a fully funded pension system will take a multi-faceted approach that should be culminated through engagement and collaboration. We are here to be an independent resource and to serve as a catalyst for those discussions across the state.

Our website includes funding ratios provided by the Illinois’ Department of Insurance, an educational course on pensions, and more information on the history of the pension system in Illinois. The graphs you mentioned were included as an example of one’s pension in relation to the funding ratio of the specific fund. We believe that the headline and the disclaimer, “The funded ratio of your retirement system will not directly correlate with the portion of your pension that you end up receiving. The likely scenario is that everybody will get their full benefits for as long as the fund is solvent. When a fund becomes insolvent, your retirement is in peril, ” make it clear that the graph is for illustrative purposes only.

As for our nonprofit, we received seed-funding from Ira Weiss. Ira is a professor at the University of Chicago and the son of two CTU members/retired Chicago Public Schools teachers.

We hope that this helps dispel any misunderstandings.

1) If a news reporter at WBBM was terribly confused, then I don’t see how that wouldn’t also happen to an average citizen.

2) Not mentioned is that Weiss is also a partner in a venture capital fund.

posted by Rich Miller

Friday, Aug 4, 23 @ 11:40 am

Comments

Add a comment

Sorry, comments are closed at this time.

Previous Post: Caption contest!

Next Post: Question of the day

Last 10 posts:

more Posts (Archives)

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I’m at the point where I am starting to assume that the vast majority of journalists are just mailing it in. There are still a number of excellent journos out there who do good work, but they seem vastly outnumbered by the guys who just take clearly skewed or outright false talking points from biased sources and breathlessly repeat them, giving them an air of credibility.

Those media types are actively harming our state and our country, making it more difficult to have an informed populace.

Comment by Homebody Friday, Aug 4, 23 @ 11:52 am

Sure Greg, but Bally’s net income for the first six months of 2023 is over double what it was for 2022.

https://s29.q4cdn.com/580102441/files/doc_news/2023/Q2/Q2-2023-Earnings-Release-Final.pdf

I am not an accountant, but I know rooting for failure when I see it.

Comment by Three Dimensional Checkers Friday, Aug 4, 23 @ 11:59 am

A 0% funded pension system is a pension system nonetheless, albeit a pay-as-you-go pension system. Everyone still gets their pension check with none of the advantages of stock market returns to offset the cost. But they’ll most definitely get their checks.

Comment by City Zen Friday, Aug 4, 23 @ 12:04 pm

This, for me, is an erosion of checking the realities of “what is real and possible”.

I can rattle off some incredibly talented reporters that understand the simple reality of this post… and pensions.

These reporters understand the ILSC ruling, the constitutionality, they can even talk to the phony politics to a want not possible.

Where this fails is this idea that “both sides might be worth a discussion” with no context to the impossibility.

It’s a dead story, when the end game makes any discussion silly to the “ifs”

It’s more responsible to reiterate the why it’s not possible than to merely explain the thinking in a context of “what if”

It helps the purposeful disinformation of that vertical integration that Proft and Timpone grift off of to the delight of their checking accounts.

Comment by Oswego Willy Friday, Aug 4, 23 @ 12:09 pm

It makes me wonder if they are using the right numbers…. A $66,000 average salary would be about a $38,000 pension after 34 years of service.

Comment by Ducky LaMoore Friday, Aug 4, 23 @ 12:09 pm

==The city was granted a casino license to boost payments.==

Can someone remind me of the annual pension payment amounts expected from the casino? I can’t find a hard number anywhere.

Comment by supplied_demand Friday, Aug 4, 23 @ 12:09 pm

Hopefully their unions are providing more accurate information. My summation, we really miss beat reporters who knew their subjects.

Comment by levivotedforjudy Friday, Aug 4, 23 @ 12:14 pm

Finding the “roots” of this organization will be interesting. Meanwhile lets also remember many believe the state pensions are also protected by the U.S. Constitution too.

Comment by Annonin' Friday, Aug 4, 23 @ 12:22 pm

It all depends on the pension system they are in. IMRF pays out 100% of your salary after 40 years. SERS maxes out at 75% after 44.5 years. 34 years in SERS would give you 56% of your average of your best 8 years out of your last 10 years if you are tier two.

MWRDRF site says, “Benefits accrue at 2.20% per year for the first 20 years, and at 2.40% per year for each year thereafter.”

So that is 77.6% of your average salary of your last 2 years for tier 1. Not counting any possible early retirement penalty.

Comment by DHS Drone Friday, Aug 4, 23 @ 12:22 pm

Deliberate liars.

Comment by Anyone Remember Friday, Aug 4, 23 @ 12:30 pm

===It all depends on the pension system they are in===

No, it doesn’t. If you’re supposed to receive a $66,000 pension according to your pension system, then you’re receiving $66,000.

Please slow down and read.

Comment by Rich Miller Friday, Aug 4, 23 @ 12:31 pm

===It makes me wonder if they are using the right numbers===

They’re using made-up numbers. The article claims somebody who was supposed to receive an $X pension is receiving far less.

Comment by Rich Miller Friday, Aug 4, 23 @ 12:33 pm

I’m sure this AstroTurf concern trolling effort didn’t deliberately pick a name easily confused with actual organizations like SERS and SURS.

And yes reporters are phoning it in a lot - it’s how TV, radio and many newspapers are run on the cheap now. Makes them vulnerable to manipulation by motivated and well financed people with agendas.

Comment by Give Us Barabbas Friday, Aug 4, 23 @ 12:34 pm

Pension system & numbers — mix of lazy journalism and where in the fiscal year said government is. For instance July - June, Counties Dec - Nov, and municipals and other districts are May - April?

Comment by CornfieldCowboy Friday, Aug 4, 23 @ 12:44 pm

*For instance state is July-June*

Comment by CornfieldCowboy Friday, Aug 4, 23 @ 12:44 pm

@DHS Drone –It all depends on the pension system they are in. IMRF pays out 100% of your salary after 40 years.–

I think that is incorrect. An IMRF annuity “shall not exceed 75% of the final rate of earnings of the employee.” 40 ILCS 5/7-142(a)1.a.

Comment by Retired SURS Employee Friday, Aug 4, 23 @ 12:48 pm

More scare tactics from the right wing, as their public employee union busting is going pretty badly, per BLS annual unionization data (less than 1% drop off since Janus in 2018). They are utterly grasping at straws at this point.

Comment by Grandson of Man Friday, Aug 4, 23 @ 12:50 pm

Sounds like this group is not familiar with the IL Supreme Court’s ruling in The People ex rel. Sklodowski vs. The State of Illinois, 182 Ill.2d 200 (1998).

Comment by Davos Friday, Aug 4, 23 @ 12:52 pm

Be careful in saying things like “boost payments”. The casino proceeds are only to be used to support the City’s required contribution in any given year–they aren’t an “extra” payment on top of the required annual contribution (see below from the Pension Code):

“Any proceeds received by the city in relation to the operation of a casino or casinos within the city shall be expended by the city for payment to the Firemen’s Annuity and Benefit Fund of Chicago to satisfy the city contribution obligation in any year.”

Comment by SAGSummer Friday, Aug 4, 23 @ 1:00 pm

Rich, check the group’s filings with the IRS. The principal officer is Ira Weiss, managing director of Hyde Park Venture Partners.

Comment by Drifter182 Friday, Aug 4, 23 @ 1:01 pm

Sadly this is what happens when “journalists” merely relay false information and propaganda from dubious sources and cast it as news. It’s a far cry from actual reporting but has become prevalent.

Comment by Pundent Friday, Aug 4, 23 @ 1:04 pm

==then this is the kind of situation you could be facing==

This website is the financial equivalent of “what if you went back in time and stopped your parents from marrying?”

Comment by Jocko Friday, Aug 4, 23 @ 1:14 pm

Whoever is funding this organization should ask for a refund.

As to the reporting, thinking a lesson was probably learned by the reporter by reading the comments today.

We might all be surprised by the next effort by this reporter on pensions. We sure could use more coverage on pension issues in Illinois.

Comment by Back to the Future Friday, Aug 4, 23 @ 1:52 pm

As to Jocko’s comment- “What if you went back in time and stopped your parents from marrying?” - - that was funny and summed up the website very well.

Comment by Back to the Future Friday, Aug 4, 23 @ 1:56 pm

“Please slow down and read.”

I did. Not my fault they mixed up salaries and pensions. That’s on them as you rightly pointed out. Also, I was replying to Ducky. I’ll take my apology off the air. /s

“I think that is incorrect. An IMRF annuity “shall not exceed 75% of the final rate of earnings of the employee.” 40 ILCS 5/7-142(a)1.a.”

My bad. I should have made clear I meant IMRF tier 1.

Comment by DHS Drone Friday, Aug 4, 23 @ 2:02 pm

===I’m sure this AstroTurf concern trolling effort didn’t deliberately pick a name easily confused with actual organizations like SERS and SURS.===

You didn’t include the “/s”, but this was my first thought as well. They chose a name that sounds like a familar pension-related organization, and then throw out BS “facts”.

I might have gotten an email from them just after I got the one from “goggle” about my recovery email address. /s

Comment by Leslie K Friday, Aug 4, 23 @ 2:12 pm

“We really need to look at, not just the numbers, but also other variables and whether … it’s having an effect on recruitment and retention of public sector workers,” Dunne said.

She believes the two-tiered system, which lowered benefits for employees hired after 2011, has meant more turnover.

Not sure where to take this comment from their ED. Do they want Tier 2 to go away? Is Tier 2 the reason for retention and hiring? Are they advocates? Or are the a VC firm looking to handle the billions in assets from multiple state or municipal pension funds?

Comment by Frida's boss Friday, Aug 4, 23 @ 2:51 pm

If we’re piling on about the problems with “SIRs” which is indistinguishable from SERS, I would like to add that the website, media campaign, inability to find this organization’s website by google, and several other issues — is exactly why I think people should avoid hiring a consultant or contractor that has filed to create an LLC or S corp and then names themselves as the Director or CEO of that organization instead of the janitor, mail clerk, or social events coordinator of that strictly unnecessary entity.

Whoever put their money behind this should ask for a refund.

Comment by Candy Dogood Friday, Aug 4, 23 @ 3:40 pm

=What if you went back in time and stopped your parents from marrying?=

I’m surprised Back to the Future didn’t post that.

Comment by Proud Papa Bear Friday, Aug 4, 23 @ 4:11 pm

DHS Drone - you still have it wrong on IMRF. Tier 1 maxes out at 75% after 40 years

Comment by Vader Friday, Aug 4, 23 @ 4:18 pm

Guess my dad told me wrong. My apologies.

Comment by DHS Drone Friday, Aug 4, 23 @ 4:21 pm

Here is the website:

https://secureillinoisretirements.org/

Comment by 2023 Friday, Aug 4, 23 @ 4:22 pm

Are we spamming?

Comment by Oswego Willy Friday, Aug 4, 23 @ 4:27 pm