Several advocacy groups have proposed instituting a City of Chicago income tax of 3.5% on household incomes over $100,000. They estimate this could generate as much as $2.1 billion annually. This would, however, require authority to be provided by the Illinois General Assembly.

Local income taxes may be imposed as a percentage of salaries or wages, a percentage of state or federal income taxes or as a flat charge per week. The tax may be paid by individuals or employers. Some jurisdictions permit exemptions for low-income taxpayers or military personnel. The income tax base can include:

-

• Earned income from wages, salaries, tips and other forms of taxable employee pay;

• Proprietary income from privately owned businesses;

• Corporate income; and/or

• Personal income, which includes compensation from salaries, ages and bonuses; dividends and distributions from investments; rental income; and business profit sharing.

The income tax base can be narrow or broad. The narrowest base for local income taxes includes earned and proprietary income only, as is the case in Pennsylvania. The broadest tax base includes personal, proprietary and corporate income, as in New York City.

The Illinois Constitution provides that home rule units of governments such as the City of Chicago may only impose a local income tax if that authority is granted by the General Assembly, and it has not done so to date. The City of Chicago Inspector General’s Office estimated in 2011 that a 1% municipal income tax could raise approximately $500 million.

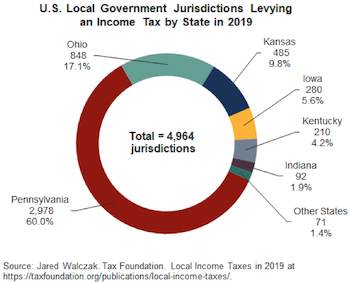

According to the Tax Foundation, approximately 4,964 local government jurisdictions in 17 states imposed local option income taxes in 2019. They are primarily municipalities and counties. Nearly 60% of the jurisdictions are in Pennsylvania.

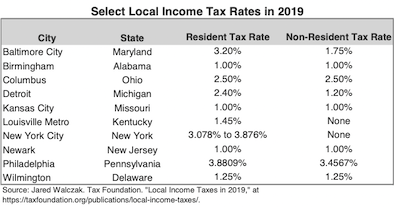

Local income tax rates vary widely. In most jurisdictions, the local income tax is levied on residents as well as residents who work in the taxing jurisdiction. The non-resident tax rate is typically lower than the rate imposed on residents. The exhibit below shows a sample of local income tax rates for select jurisdictions. Most jurisdictions impose a flat rate income tax. New York City, however, has implemented a graduated rate levy.

Pros and Cons of a Local Income Tax

There are several arguments in favor of a local option income tax:

-

• They can replace or reduce the need for increasing other more regressive taxes such as property or sales taxes;

• Income taxes are an elastic revenue source that yields greater amounts of revenue as the economy grows;

• The use of income taxes contributes to revenue diversification, thereby lessening reliance on other revenue sources such as property taxes;

• Income taxes can generate significant amounts of revenue; and

• If imposed on nonresidents who work in a jurisdiction, local income tax revenue can be

used to help pay for municipal services and infrastructure used by those nonresidents.

The arguments against local income taxes include:

-

• A local income tax may be a disincentive to live, work or do business in a city imposing the tax. Mitigating this impact might involve extending the tax to nonresidents or imposing a county or regional income tax rather than a municipal tax;

• It may be easy to avoid a local income tax that is only imposed on residents by moving out of the jurisdiction;

• A local income tax base will be shared with federal and state income taxes, which may lead to a high composite tax rate;

• The 2017 federal tax reform act limits deduction of local taxes, increasing the relative burden on taxpayers;

• Because income taxes are elastic, there may be significant fluctuations in revenue. In economic downturns, income tax revenues may fall precipitously, forcing governments to find alternative funding sources;

• A local income tax can export the tax burden to nonresidents who do not fully utilize city services; and

• A local income tax applied to corporate income may negatively impact economic development if it is perceived to create an unfavorable business climate.

Nope. Make them fix the State’s relatively narrow sales tax base and expand it to some services before whacking every paycheck in the City.

See also point #1 of the Civic Fed’s points against. If you want to make 5 day a week work from home permanent for Loop office workers pass a income tax on employees that applies to non-residents who live outside Chicago but work downtown.

Comment by ChicagoBars Tuesday, Jun 20, 23 @ 10:35 am

Certainly not. Is there any point where Government should be asked to pair back what it does, instead of forever expanding the powers of taxation?

Comment by Chicago Republican Tuesday, Jun 20, 23 @ 10:35 am

No. bit by bit…town by town… is not the way to go. should have done it statewide. return to municipalities from statewide coffers the way to go so need service taxes, government consolidation. (also $100k is not as much as it seems.)

Comment by Amalia Tuesday, Jun 20, 23 @ 10:43 am

I’ll note from my end of the world that in Maryland each county has its own local income tax in addition to Baltimore City’s income tax. Baltimore City is essentially a county. Coming from never having had to pay a local income tax to now paying one, it is still annoying come tax time.

Comment by CLJ Tuesday, Jun 20, 23 @ 10:43 am

yes- Let Chicago pursue every local funding source to fund its expenses.

Comment by Donnie Elgin Tuesday, Jun 20, 23 @ 10:43 am

Yes.

Allowing local taxes through legislation, doesn’t automatically mean a local area would be forced to implement it. It would be up to the individual municipality.

Municipalities and the IML complaining about the LGDF disbursements can just cut out the middle man and collect those taxes directly from their residents. This has the benefit of reducing the amount of layers and makes the taxation much more visible at the local level. It’s easy for local officials to say they want more LGDF money from the state, which comes from the local residents but is hidden behind more layers. It’s harder to go to the local residents directly and ask for exactly the same money.

This then has the benefit of permanently disarming the seemingly constant refrains from the IML on the LGDF distributions.

It’s not functionally much different than the RTA tax that collar counties are paying right now. Granted, that’s an extra fractional percentage added on to sales tax, and not income tax, but the regional taxation functionality and ability is similar.

As for limitations, the only one I can think of now is that after the legislation is passed at the state level to allow it, the specific taxation should also require a local referendum to pass defining the amount of taxation. Similar to how home rule municipalities already do a referendum to add additional local sales taxes, or school districts have a referendum to sell bonds for new construction.

Much of this proposed process already exists in various other forms. There’s no reason this proposal can’t ort shouldn’t be enacted. The end result would then sit in the hands of the local voters to approve or not.

Comment by TheInvisibleMan Tuesday, Jun 20, 23 @ 10:49 am

No. If a local income tax is allowed, the taxing municipality will have to develop their own version of the IRS. It is bad enough now to have the federal IRS and the Illinois Department of Revenue. Can anyone imagine how bad a Chicago IRS could be? Yikes.

Comment by Huh? Tuesday, Jun 20, 23 @ 10:54 am

– bit by bit…town by town… is not the way to go.–

Indiana has had county-level income taxes since 1973, in addition to state income taxes. They range from 1.00 to 2.864. That’s in addition to the 3.23 state income tax. That means there are counties in Indiana with a higher combined state and county income tax than Illinois. The highest being 6.094 - compared to the flat Illinois rate of 4.95.

Comment by TheInvisibleMan Tuesday, Jun 20, 23 @ 10:56 am

Yes.

Abolish LGDF and let the locals raise the money/taxes if they want the revenue.

Comment by Michelle Flahery Tuesday, Jun 20, 23 @ 10:58 am

$100k household income in Chicago seems low. That would only be about 20% over 2025 minimum wage in Springfield/downstate dollars in a two-income household.

Comment by Moby Tuesday, Jun 20, 23 @ 11:13 am

==If you want to make 5 day a week work from home permanent for Loop office workers pass a income tax on employees that applies to non-residents who live outside Chicago but work downtown==

Why would they pay a city tax when they’re not working in the city nor consuming city resources?

Pass it, but limit the tax base to residents only (what NYC does). Let Chicago tax themselves into oblivion if they want.

Comment by City Zen Tuesday, Jun 20, 23 @ 11:21 am

==Allowing local taxes through legislation, doesn’t automatically mean a local area would be forced to implement it. It would be up to the individual municipality.==

The same reasoning applies to bankruptcy.

Comment by City Zen Tuesday, Jun 20, 23 @ 11:23 am

“The same reasoning applies to bankruptcy.”

Can you expand on this?

It also applies to home rule sales taxes. Which exist in many municipalities other than Chicago right now.

Comment by TheInvisibleMan Tuesday, Jun 20, 23 @ 11:28 am

No. I believe the City of Chicago should address it’s revenue issues through property taxes like every other municipality in the state. A commuter tax will discourage people from working in the city at a time when the economy is still suffering from the pandemic shift to remote work.

Comment by Pundent Tuesday, Jun 20, 23 @ 11:33 am

Chicago’s 2013 budget was $8.35 billion. Chicago’s 2023 budget is $16 billion. That’s a 100% increase in ten years. How about addressing the spending part of the equation?

Comment by Boone's is Back Tuesday, Jun 20, 23 @ 11:35 am

Yes - 100K probably too low. Go to 200K and a lower rate for non-residents working in the city. Would need to be coupled with some property tax relief but shouldn’t be revenue neutral. Having this as a revenue option could mitigate some of the property tax burden that taxes people out of their homes in gentrifying neighborhoods.

Comment by Old Fogey Tuesday, Jun 20, 23 @ 11:55 am

====Abolish LGDF and let the locals raise the money/taxes if they want the revenue.=====

Well most of the locals can have their own local sales tax if they want.

Comment by Been There Tuesday, Jun 20, 23 @ 12:02 pm

Yes, but start at $250,000. A family making 100k is likely struggling to live in the city.

If they pass it, Chicago’s state money gets frozen.

Comment by JS Mill Tuesday, Jun 20, 23 @ 12:08 pm

No, because unless you allow progressive income taxation in Illinois: it will apply to everyone.

Comment by Steve Tuesday, Jun 20, 23 @ 12:13 pm

==Can you expand on this?==

Illinois currently does not allow cities to file for bankruptcy nor enact a city income tax.

Paraphrasing what you said, allowing either through legislation doesn’t automatically mean a local area would be forced to implement either. It would be up to the individual municipality. The point being if we’re going to empower the locals with one financial tool, why not the other?

==Yes - 100K probably too low. Go to 200K.==

Unconstitutional. You can only have one tax rate on income. Your plan has two.

Comment by City Zen Tuesday, Jun 20, 23 @ 12:19 pm

Are municipalities exempted from the state constitution’s flat tax requirement? If not, are you allowed to exempt the under-$100K?

Comment by lake county democrat Tuesday, Jun 20, 23 @ 12:20 pm

No. Now is not the time to create disincentives to live and work in Chicago when the city is still recovering from the pandemic. A solution at the regional level may be more workable; all a municipal income tax would accomplish is pushing high income families into the suburbs.

Comment by lollinois Tuesday, Jun 20, 23 @ 12:25 pm

To consider local income taxes to boost revenue is ludicrous when we pay “transportation taxes” to avoid the CTA.

Can we claim a tax credit when we are forced to use a taxi or car service (Uber/Lyft) because the CTA trains are dirty, dangerous, and crime-ridden?

Comment by Rudy’s teeth Tuesday, Jun 20, 23 @ 12:35 pm

No. This would create an overwhelming unfavorable business environment.

Comment by Lurker Tuesday, Jun 20, 23 @ 12:40 pm

No, because this is a band-aid approach to solving the bigger issue of the state’s overreliance on property taxes. Instead of adding a local income tax, fix tax revenue at the state level.

Comment by Original Anon Tuesday, Jun 20, 23 @ 12:54 pm

No. Only consider it if they exempt them from the LGDF.

Comment by Just Another Anon Tuesday, Jun 20, 23 @ 12:59 pm

I could support the concept, but the devil is in the details. As we all know, income taxes are based in theory on ability to pay, property taxes are not.

OTOH, I have a hard time seeing how this gets 60-30-1 in the foreseeable future, so it’s probably a moot point.

Comment by 47th Ward Tuesday, Jun 20, 23 @ 2:02 pm

==Are municipalities exempted from the state constitution’s flat tax requirement?==

Nope. “A tax on or measured by income shall be at a non-graduated rate.” It doesn’t specify the taxing body, so the default is every taxing body.

Comment by City Zen Tuesday, Jun 20, 23 @ 3:25 pm