Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x1 *** Question of the day: 2022 Golden Horseshoe Awards

Next Post: Sen. Hastings will not chair a committee in new GA, but caucus is divided

Posted in:

* Daily Herald…

Since recreational marijuana sales were legalized statewide in January 2020, taxes and fees have generated more than $850 million for Illinois.

Last month alone, the 110 recreational dispensaries throughout Illinois collected $131,547,031 in revenue, their fourth-highest monthly tally ever.

But those sales figures have remained relatively flat since March, leading some to worry the state’s cannabis cash cow has reached the highest hill in the state’s revenue pasture. […]

[Pam Althoff, executive director of the Cannabis Business Association of Illinois] cited inflation, more workers returning to the office after the COVID-19 pandemic and the state’s high tax rate on marijuana as reasons sales have leveled off.

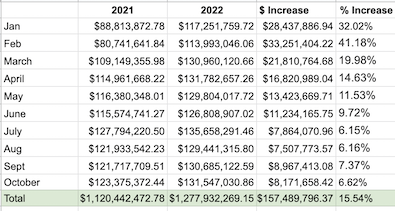

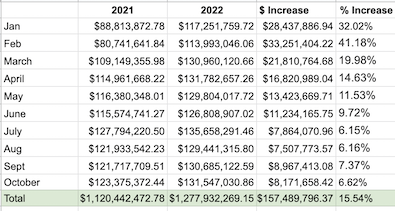

* I asked Isabel to compile some numbers from two state sources and produce this chart…

As you can see, growth is definitely slowing, but a 6-7 percent increase the past several months year-over-year is still pretty darned good, considering the run they’ve had.

* Not to mention this tidbit from Crain’s…

Profits in Illinois also remain higher than elsewhere, with retailers here selling marijuana for 48% more than they pay to buy it from growers in the state. That works out to a gross profit of about $7.62 per gram in Illinois, compared with $4.62 in Massachusetts and $1.84 in Michigan, Cantor Fitzgerald says.

If the retailers think prices are too high, maybe cut their own prices first? Hopefully, with more competition coming soonish, they’ll have no choice but to cut prices.

* Also, from ABC 7…

Twenty five percent of Illinois’ pot tax goes to non-profit organizations with small budgets in communities designated as socioeconomically disadvantaged. Another 20% of the state’s marijuana tax revenue goes to substance abuse, prevention and mental health care programs.

Cutting the cannabis tax means reducing those programs unless the tax cut is completely offset by higher sales. But there’s no guarantee of that happening.

* Related…

posted by Rich Miller

Monday, Nov 28, 22 @ 1:14 pm

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x1 *** Question of the day: 2022 Golden Horseshoe Awards

Next Post: Sen. Hastings will not chair a committee in new GA, but caucus is divided

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Inflation. LOL. The going rate for a certain standard amount pre-tax - $30 - is the same as it was early on in 2021. And that same amount pre-tax is in the $18-20 range in Michigan. It’s lack of competition and gouging in a hot market, plain and simple.

Comment by Roadrager Monday, Nov 28, 22 @ 1:19 pm

A monopoly making 48% needs rate fixing

Comment by Rabid Monday, Nov 28, 22 @ 1:28 pm

hopefully the competition comes soon

prices are unacceptably high

need more production in state

legalize small personal grow

Comment by halving_fun Monday, Nov 28, 22 @ 1:30 pm

Seems like some folks need to be reigned in and if they won’t do it themselves…

I’ve said it before but my ‘regular’ purchase is roughly 40% less in Michigan vs in Illinois. And they’ll bring it to your door to boot

Comment by Joe Bidenopolous Monday, Nov 28, 22 @ 1:33 pm

Businesses with large and/or increasing profit margins who then blame high prices on other people? I’m shocked and appalled. No one would ever do this in any other industry. Certainly not the pharmaceutical, petroleum…

… oh, right.

Comment by Homebody Monday, Nov 28, 22 @ 1:37 pm

In my area, a 1 gram cart is still over $100 out the door. There is no competition, no deals, and no sign of relief.

Comment by Kayak Monday, Nov 28, 22 @ 1:59 pm

= Cutting the cannabis tax means reducing those programs =

Three years ago, these expenditures were $0.00. Then they became very large.

If they fall back due to lower taxes, that would still involve positive income for these programs. It would just be less that the previous two years, and would still be new monies.

I actually think having more distributors throughout the state would increase sales. And having competition within communities and throughout the state, would potentially allow lower prices and increased expenditures on the two programs noted.

Comment by H-W Monday, Nov 28, 22 @ 2:12 pm

When enough is never enough.

Comment by Bruce( no not him) Monday, Nov 28, 22 @ 2:19 pm

If Illinois’ retailers begin to see realized prices similar to the rest of the country (due to competition, economy, etc.), State tax revenues will begin to collapse. Any volume increase due to more stores will be more than offset due to declining prices.

Comment by Occam Monday, Nov 28, 22 @ 2:23 pm

I’m not convinced that lowering the taxes will result in massive losses to non-profit revenue / program funding.

Everyone think back to your high school economics class for a minute. If you lower price, demand will go up. There is also the reality that many people risk breaking the law to buy from home growers / black market. If a lower tax can help decrease the currently wide margin between legal and illegal prices, I imagine at least some of the black market buyers will switch to legal to avoid risk.

Also this is not inelastic demand. This is a non-habit forming luxury good, and making it more affordable would likely result in people buying more product. I’m not saying that it would be enough to increase funding, or completely wash away the revenue; but I don’t think it will be as major as people are worried about.

Comment by Commissar Gritty Monday, Nov 28, 22 @ 2:31 pm

=I’ve said it before but my ‘regular’ purchase is roughly 40% less in Michigan vs in Illinois.=

Not initially but now that is definitely true.At the beginning Michigan prices were high as well (no pun intended).

I have a good friend in Michigan and spend a fair amount of time their. It seems like competition is starting to weed out some of the weaker operations. That will probably happen here too.

=State tax revenues will begin to collapse.=

Maybe only one edible this early in the day the next time, ok?

Revenue will only collapse if people quit using the product. The quality is off the charts and super expensive now, and people are using a lot. And you think cheaper prices will make them use less? Not likely.

Comment by JS Mill Monday, Nov 28, 22 @ 2:32 pm

===Everyone think back to your high school economics class===

That class has ruined more minds than just about anything in education.

Comment by Rich Miller Monday, Nov 28, 22 @ 2:33 pm

So who are the individuals who will receive this big proposed tax break? State Secret, can’t say if you knew, right?

Comment by Bill H. Monday, Nov 28, 22 @ 2:35 pm

===State Secret, can’t say if you knew, right? ===

What are you blabbering about?

Comment by Rich Miller Monday, Nov 28, 22 @ 2:37 pm

–Inflation. LOL.–

Th inflation being discussed is the inflation GTBIF is facing on input costs. They are paying more for fuel and other core expenses in their business model.

They aren’t saying inflation as in increasing the price of the product to the consumer. They are saying quite the opposite in fact, that they were able to successfully manage input inflation costs to them without passing on additional costs to the end user AND still had an increase in margins.

Lowering the tax rate should be last on the issues to address regarding cannabis. Work on home-grow legalization first, as that is still a criminal act which in the bordering state of Missouri is completely legal. Work on equity ownership next, as that was one of the core stated purposes of why cannabis was legalized in the legislature to being with. Taxes are the last concern I have with cannabis, and that issue would even be a sub-issue tied in with a first priority of allowing home grow legalization.

Comment by TheInvisibleMan Monday, Nov 28, 22 @ 2:37 pm

“retailers here selling marijuana for 48% more than they pay to buy it from growers in the state. ”

And this is why so many of my friends never deleted the weed-man’s number.

(They’re older kids. From two towns over. You wouldn’t know ‘em.)

– MrJM

Comment by MisterJayEm Monday, Nov 28, 22 @ 2:44 pm

I highly support The People’s Market.

Comment by Dotnonymous Monday, Nov 28, 22 @ 3:04 pm

I can attest to cheap MI prices — $65/oz, yes an ounce - while visiting my parents for T’giving. Quality was good, not great. But, as suggested by some of the comments, your local weed guy doesn’t survive with legal that cheap. She still thrives here in IL, however.

Comment by WestBurbs Monday, Nov 28, 22 @ 3:34 pm

MrJM - hilarious!! I used that line all the time in my ill-spent youth — “You wouldn’t know ‘em.”

Comment by WestBurbs Monday, Nov 28, 22 @ 3:35 pm

I pay for my Colorado hotel with the cannabis savings when I make my twice-yearly visit to the Rocky Mountains.

Comment by Vote Quimby Monday, Nov 28, 22 @ 3:57 pm