Governor JB Pritzker and the Illinois Department of Commerce and Economic Opportunity (DCEO) today announced that $8.75 million in Direct Forgivable Loans fully financed by the State will be made available to all conditionally-approved social equity loan applicants in order to provide immediate access to capital. Pending the completion of a simplified documentation process, forgivable loan amounts between $50,000-$500,000 will be released immediately.

“Equity has always been at the core of our cannabis legalization process. It’s why we expunged hundreds of thousands low-level cannabis charges and instituted the Cannabis Social Equity Loan Program. But I know that if we want to create a truly equitable cannabis industry in Illinois, we must give our business owners the resources they need to grow—both figuratively and literally,” said Governor JB Pritzker. “That’s why we are launching this Direct Forgivable Loan Program to provide a much-needed jumpstart for social equity applicants who’ve faced hurdles in pursuit of capital funding. This $8.75 million will help our social equity licensees open their doors for business—a major step towards creating a prosperous cannabis industry here in Illinois.”

The Cannabis Social Equity Loan Program is a first-of-its-kind program that launched in the summer of 2021 with the goal of providing low-interest loans to social equity licensees through a partnership with lending institutions. Program participants have encountered significant delays in receiving capital through financial institutions due to the complexities of navigating a new industry that remains illegal under federal law, as well as institutions’ fiduciary, regulatory responsibilities and underwriting standards that are set independent of the program.

In response to feedback from participants, and out of an unwavering commitment to increasing equity in the cannabis industry, DCEO’s new Direct Forgivable Loan Program will make funding from the state available to all eligible program participants regardless of their original loan application status with a lending partner. Interested participants can continue to pursue funding through the original loan program, while also receiving the new Direct Forgivable Loan.

“In Illinois, we are striving to create an ecosystem for cannabis entrepreneurs that prioritizes those who have been adversely impacted by the war on drugs,” said Lt. Governor Juliana Stratton. “The creation of the Direct Forgivable Loan Program is a critical step in that mission. We are forging ahead to support social equity licensees’ businesses so that Illinoisans can thrive alongside this growing industry.”

“Creating a more equitable cannabis industry in Illinois is the driving force behind the State’s loan programs and today’s announcement will accelerate our vision by making immediate capital available to social equity licensees,” said DCEO Director Sylvia I. Garcia. “Looking ahead we will continue working closely with licensees as we implement the new Direct Forgivable Loan Program and incorporate program improvements for future rounds of funding.”

A total of $8.75 million will be available through the new Direct Forgivable Loan Program. The following loan amounts are available per participant based on the business type:

-

• Craft Growers: $500,000

• Infusers: $250,000

• Transporters: $50,000

Because DCEO has already received significant documentation from program participants, the additional documentation requirements for a direct forgivable loan are minimal to allow for prompt disbursal of funds. The forgivable loan has an 18-month grace period with no payments or interest accrued to provide businesses with flexibility.

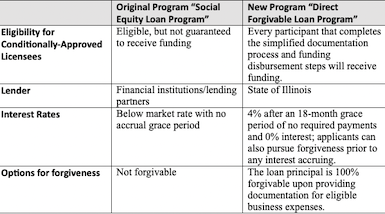

Loan forgiveness will be provided to recipients upon receiving documentation of a broad array of eligible expenses currently accrued or accrued during the loan period, including rent, payroll, utilities, inventory, debt, regulatory expenses, legal fees, equipment and much more. The main differences between the programs are as follows:

Looking Ahead: Continued Collaboration with Licensees

Through the original loan program, social equity applicants were conditionally approved to pursue loan funding directly with lender partners. While conditional approval did not guarantee funding through the financial institutions, the program was designed to incentivize lending to social equity licensees to the greatest extent possible. As part of the structure, DCEO committed to funding a portion of each loan– thereby assuming a portion of the risk and making lending more attractive to lenders.

With many applicants still in the process of seeking loans through the original program, DCEO will continue to work closely with partners in an effort to secure loan funding for applicants who wish to complete the loan application process. Any loan funding provided through the original program would be in addition to the Direct Forgivable Loan funded by the State. In addition to providing additional capital, securing a loan from a financial institution can help add to the legitimacy of the social equity applicant’s business model and help attract capital from additional investors.

Cannot wait for the Charles Thomas response.

Comment by Thomas Paine Thursday, Nov 10, 22 @ 12:13 pm

Long overdue. You gotta think this would have been announced before the election if JB was worried about the outcome.

Comment by Henry Francis Thursday, Nov 10, 22 @ 12:20 pm

==== A total of $8.75 million ===

Better than nothing but they could probably use about 10 times that amount

Comment by Been There Thursday, Nov 10, 22 @ 12:21 pm

You could buy (1) pound of AAA light dep weed for $300/400 dollars today…if interstate commerce applied to pot…also.

The only reason weed was ever “expensive” was because it was illegal.

Comment by Dotnonymous Thursday, Nov 10, 22 @ 12:54 pm

In fact so overdue there is no way in the current framework these people can compete with the big three which will probably soon be big two until there’s one company. Too little way too late.

Comment by P Thursday, Nov 10, 22 @ 12:58 pm

Outstanding. Another home run for the administration.

Comment by low level Thursday, Nov 10, 22 @ 1:01 pm

Make the loans, yes. Why would they be forgivable?

Having a license in this industry is a license to print money as these endeavors are obscenely profitable. Having the cash flow to repay the loan 100 fold is a given

Comment by Really? Thursday, Nov 10, 22 @ 1:21 pm

== The only reason weed was ever “expensive” was because it was illegal.==

Because of the lack of competition here in IL, the black market has lower prices than what legal dispensaries charge. I don’t know if this is true in other states, although I doubt it considering that legal dispensaries in other states charge far less than they do in IL.

Comment by Henry Francis Thursday, Nov 10, 22 @ 1:28 pm

Yes, the price of legal cannabis in Illinois is high, but the peace of mind is worth it for me and lots of people like me, ie, older people with money who still like to enjoy it occasionally. Plus, knowing exactly what you’re getting is a big improvement over the guys I knew in college who were smoking sawdust and ditch weed.

Comment by 47th Ward Thursday, Nov 10, 22 @ 1:42 pm

One shouldn’t have to pay exorbitant prices for peace of mind.

It’s 2022…by the way.

Comment by Dotnonymous Thursday, Nov 10, 22 @ 1:53 pm

As well intentioned as the social equity set-aside is, I have always questioned whether it would work. Some industries just require huge sums of capital to get in the game. That is why the big tobacco companies jumped into it and why people like Sean “Diddy” Combs are getting into it. You have to have substantial resources. It is hard enough for a minority owned business to get a bank loan and in this industry, even that is nearly impossible.

Comment by levivotedforjudy Thursday, Nov 10, 22 @ 2:11 pm

legalization in Missouri will undoubtedly test the market strength in border towns. competition is always good for the consumer.

Comment by Blue Dog Thursday, Nov 10, 22 @ 2:35 pm

===It’s 2022…by the way.===

Thanks for reminding me kid.

Comment by 47th Ward Thursday, Nov 10, 22 @ 2:43 pm

“Craft Growers: $500,000

Infusers: $250,000

Transporters: $50,000″

So no loans for dispensary owners? Interesting, I thought that was part of the issue here, that no dispensaries are owned by people of color.

Comment by Techie Thursday, Nov 10, 22 @ 3:58 pm

Absent a token legal homegrow for we law abiding (and fortunately healthy) Illinoisans who truly want to know what went into or onto the product, I’m not much interested in supporting/funding criteria-based startups in “the industry”, then paying premium prices, and huge taxes — social equity or not.

Comment by XonXoff Thursday, Nov 10, 22 @ 4:42 pm