Capitol Fax.com - Your Illinois News Radar

Latest Post |

Last 10 Posts |

Archives

Previous Post: It’s just a bill

Next Post: Reader comments closed until House reconvenes Sunday afternoon at 4

Senate Dems want to up Pritzker’s ante on election-year tax cuts, but House and governor are so far non-committal

Posted in:

* The governor’s office is saying they weren’t briefed on today’s $1.8 billion Senate Democratic proposal to cut taxes. Here’s Jordan Abudayyeh from Pritzker’s office…

We look forward to reviewing this proposal. Our conversations with members of the General Assembly in both chambers have been productive, and we will continue to focus on delivering fiscally responsible relief for working families.

House Speaker Chris Welch received a brief phone call about half an hour before the press conference. From Welch’s spokesperson Jaclyn Driscoll…

The Senate President did reach out to the Speaker shortly before the plan went public, but he still has not been thoroughly briefed on the details. He plans to review the proposal and discuss it in detail at the next caucus.

I’ve been hearing that Welch isn’t enamored at all with the idea of handing out tax breaks to upper-income earners. But he hasn’t had much time yet to digest this new proposal.

* The Senate Democratic plan would do things like pare back Pritzker’s one-year gas and grocery tax freeze/cut proposals to just six months in order to fund other items. But, at least it’s in there.

Look, the Senate’s gonna Senate, but let’s see how hard they decide to fight for all of these things. This looks like it could be, at least in part, member management. But, hey, at least they didn’t demand this stuff next Wednesday or Thursday. There’s still time to figure things out.

* By the way, these sorts of ideas have never really worked well in the past, politically speaking, including here in Illinois.

Senate GOP Leader Dan McConchie…

The Senate Democrats’ proposal appears to be just another election year stunt. Under their plan, checks and relief will arrive right before the election and then will expire right after the election. This is not the real reform the people of this state want and need, and Illinoisans will see right through this disingenuous gimmick.

* It is quite comprehensive, though. Here’s the press release…

Illinois Senate Democrats proposed Friday a more than $1.8 billion inflation-busting relief plan that would wipe out state taxes on back-to-school shopping and groceries, stop higher gas taxes and deliver income and property tax refund checks statewide.

“This plan gets money back in the hands of consumers. They’ve endured through this pandemic. It’s time for the state to pay it forward,” Senator Scott Bennett (D-Champaign) said at a Capitol press conference.

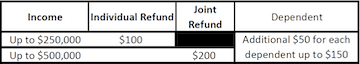

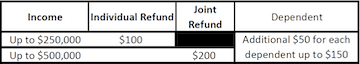

Under their plan, the state would directly deliver relief checks valued at $100 per person and $50 per child to state taxpayers making up to $250,000 individually or up to $500,000 jointly. A household of four could see a $300 check.

The relief checks would likely come in late summer or early fall. Lawmakers estimated more than 97 percent of state taxpayers would get a check of some amount.

The plan also wipes out for six months the state sales tax on groceries and stops a gasoline tax increase from happening. The proposal is modeled after one Gov. JB Pritzker proposed in his budget speech earlier this year.

“We’re going to drive down skyrocketing gas and grocery costs and give people some needed relief,” said Senator Elgie Sims (D-Chicago).

The plan also includes property tax relief checks of up to $300 that would be mailed to taxpayers. This idea is also one that originated with Gov. Pritzker’s budget proposal.

“Homeowners need help and this plan delivers direct relief to them,” said Senator Ann Gillespie (D-Arlington Heights).

The plan also wipes out the state sales tax on clothing, shoes and school supplies for 10 days in August to give consumers an economic boost as they go back-to-school shopping. As proposed, the sales tax would be lifted from Aug. 5 to Aug. 14.

“This recognizes the reality that families across the state face and should help lower the bill on their back-to-school shopping,” said Senator Michael Hastings (D-Frankfort).

The comprehensive proposal also includes expanded economic aid for lower-income workers and increased tax credits for teachers and volunteer first responders.

The plan, included in legislation filed Friday in the Senate, totals more than $1.8 billion in economic relief. It could be voted on in the coming days as the legislative session heads toward a planned adjournment on April 8.

“Through responsible budgeting the state has wiped out deficits and paid our bills. Now is the time to pay it forward and get money back to taxpayers,” said Senator Bennett.

* Dot points…

Putting money back in Illinoisans pockets

Senate Bill 1150

Paying it forward

Floor Amendment 1 (Bennett)

• The majority of Illinoisans – more than 97% of taxpayers – will receive a one-time tax refund by the fall of 2022. Individual filers will receive $100 and joint filers will receive $200, with an additional $50 for up to three dependents.

• Individuals making up to $250,000 and joint filers making up to $500,000 will receive checks in the mail.

How do people know how much they could receive from the refund?

o People should review their 2021 income tax return. If they made $250,000 or less individually, they will receive $100. If they made $500,000 or less jointly, they would receive $200.

o Individuals and households can add $50 per dependent, up to three dependents.

Who would be eligible for the refund?

o Any Illinois taxpayer who filed a 2021 tax return and makes $250,000 or less individually or $500,000 jointly. This includes taxpayers who utilized an ITIN number on their 2021 return.

What would people need to do to qualify?

o People would need to have filed their 2021 return by the filing deadline and make $250,000 or less individually or $500,000 or less jointly. Any person who fits this criteria would automatically be sent a check.

When would people receive this refund?

o The refund is expected to hit people’s mailboxes by September.

Many people have already filed their 2021 return and received their 2021 refund. What would they need to do to claim this particular refund?

o Nothing additional. Anyone who fits the income criteria and filed a 2021 return will automatically receive a check in the mail.

Suspending everyday taxes

Floor Amendment 2 (Sims)

• Addressing inflation by suspending the 1% state grocery tax for six months.

Floor Amendment 3 (Sims)

• Suspends the state’s portion of the gas tax increase for six months to help with rising prices at the pump.

Providing property tax relief

Floor Amendment 4 (Gillespie)

• Provides property tax relief for homeowners. Property owners making up to $250,000 individually and $500,000 jointly are eligible for the tax credit of 5% of property taxes paid, with a maximum check of $300.

Helping Illinois families

Floor Amendment 5 (Hastings)

• Helps families with back-to-school shopping by creating a state sales tax holiday on school supplies and clothing from Aug. 5 to Aug. 14 of 2022. Qualifying clothing and footwear with a retail price of $125 or less will have no sales tax during that time. School supplies are not subject to the $125 threshold.

Increasing the Earned Income Credit

Floor Amendment 6 (Aquino)

• Helping lower-income Illinoisans by increasing the Earned Income Credit to 19%. The current EIC in Illinois is at 18% of the federal EIC.

• Taxpayers 18-24 years of age, 65 and older, and taxpayers who use an individual taxpayer identification number would be able to claim the EIC if they would otherwise qualify for the federal EIC, which excludes these groups.

Tax Breaks for Teachers

Floor Amendment 7 (Holmes)

• Gives teachers a tax credit of up to $250 for supplies bought for their classrooms.

Relief for Volunteer First Responders

Floor Amendment 8 (Belt)

• Shows appreciation for volunteer firefighters and EMS professionals by giving them a tax credit of up to $500 for a year in which they served at least 9 months in a volunteer capacity.

posted by Rich Miller

Friday, Apr 1, 22 @ 4:42 pm

Comments

Add a comment

Sorry, comments are closed at this time.

Previous Post: It’s just a bill

Next Post: Reader comments closed until House reconvenes Sunday afternoon at 4

Last 10 posts:

more Posts (Archives)

WordPress Mobile Edition available at alexking.org.

powered by WordPress.