Latest Post | Last 10 Posts | Archives

Previous Post: Open thread

Next Post: House Republicans proposed their own one-year tax cut a couple of months before they derided Pritzker’s one-year tax cuts as “one-time tricks”

Posted in:

* From the General Assembly’s Commission on Government Forecasting and Accountability…

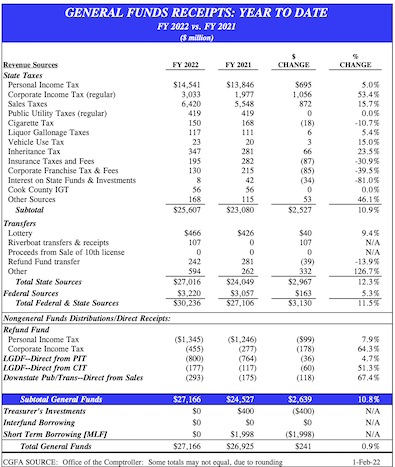

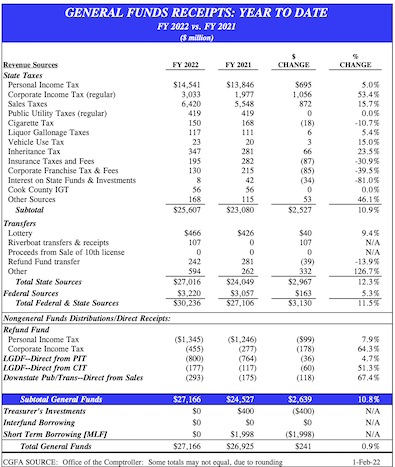

Base general funds revenues increased an impressive $1.721 billion in January. The increase was due to strong gains from the State’s largest revenue sources. Combined, net income and sales taxes jumped $1.224 billion for the month. Receipts were further bolstered by a comparatively strong performance of federal sources. January had one more receipting day compared to last year.

In January, gross personal income tax receipts led the way, growing a remarkable $1.107 billion, or $938 million on a net basis. Gross corporate income tax receipts continued its strong performance growing another $222 million, or $175 million net. Gross sales tax revenues added $123 million, or $111 million net. Other increases from State sources came from other miscellaneous sources [up $38 million]; public utility taxes [up $5 million]; and, interest on State funds and investments [up $1 million].

After falling $948 million last month, federal source revenues bounced back in January, growing $511 million. The notable monthly increase was in large part due to the small amount of federal revenues receipted last year, at only $74 million. [The comparatively small January 2021 total was because it followed the $1.325 billion in pandemic-related relief money received in December 2020, which gives context to that month’s significant decline]. The see-saw nature of federal funds in FY 2021 helps explain the similar wild swings in federal sources so far in FY 2022.

While the large revenue sources performed quite well, several of the smaller sources did experience declines in January. Corporate franchise taxes fell $39 million, while inheritance taxes dropped $33 million. Other declines came from insurance taxes [down $22 million] and cigarette taxes [down $5 million]; and vehicle use taxes [down $2 million]

Overall transfers into the general funds were collectively up $43 million in January, but individually had mixed results. A $20 million increase in riverboat transfers and a $31 million gain from miscellaneous transfers were partially offset by an $8 million decline in lottery transfers.

Year to Date

Through the first seven months of FY 2022, overall base receipts are up a remarkable $2.639 billion. As mentioned in previous monthly briefings, what makes this growth so impressive is that the revenue totals of FY 2022 are compared to FY 2021 receipts that benefitted from last year’s final payment delay, valued at approximately $1.3 billion. Despite this occurrence, net personal income tax revenues have risen $560 million and net corporate income tax revenues have increased $818 million. Net sales tax also continues its phenomenal year, now up $754 million through January. All other sources are trailing last year’s levels by a combined $96 million.

Overall transfers continue to outpace last year’s levels and are now up $440 million this fiscal year. Those gains reflect $332 million in gains from miscellaneous transfers, $107 million from the return of riverboat transfers, and $40 million improvement from the lottery. Those increases more than offset the $39 million decline in the refund fund transfer.

In summary, despite the lingering pandemic and its effect on employment, business activity, supply- chain disruptions, and building inflation pressures, FY 2022 revenues have continued to amaze. While this torrid pace cannot continue for much longer as stimulus efforts wind down and inflationary pressures build, thus far FY 2022 revenues have certainly exceeded expectations.

* Year to date…

posted by Rich Miller

Friday, Feb 4, 22 @ 9:20 am

Sorry, comments are closed at this time.

Previous Post: Open thread

Next Post: House Republicans proposed their own one-year tax cut a couple of months before they derided Pritzker’s one-year tax cuts as “one-time tricks”

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

The doom and gloom folks are having a bad week.

Comment by Big Dipper Friday, Feb 4, 22 @ 9:29 am

But, but… Illinois is failing… and everything.

To the post and the politics to it…

Tougher by the day for the GOP to vote against a structured budget Pritzker is proposing… tougher still for Bourne and Demmer.

Embrace some good, vote for a budget, get the goodies attached… and more importantly… look like someone who is bullish on Illinois.

This news helps.

Comment by Oswego Willy Friday, Feb 4, 22 @ 9:32 am

It’s all a gimmick.

Comment by Arsenal Friday, Feb 4, 22 @ 9:34 am

But Crime……

Comment by Retired and Still in Illinois Friday, Feb 4, 22 @ 9:37 am

Re: Cannabis sales

===

In 2021, these amounts increased as the cannabis market expanded. Total sales grew to $1.38 billion. This equaled growth of 106% or more than double the 2020 amount.

===

Well, that’s just amazing.

Comment by TheInvisibleMan Friday, Feb 4, 22 @ 9:38 am

I support the Governor and the FY 2023 budget, but for FY 2022, don’t mean to go all FY 1991, but let’s wait for March & April receipts.

Comment by Anyone Remember Friday, Feb 4, 22 @ 9:42 am

I’m breathlessly waiting for the take of those folks who spend their time orbiting Illinois politics just spelunking for misery.

What are they gonna say? Hmm?

Comment by Oswego Willy Friday, Feb 4, 22 @ 9:42 am

Amazing what happens coming out of a recession caused by a pandemic. I can’t wait to see what happens when the pandemic actually ends.

Comment by Bruce( no not him) Friday, Feb 4, 22 @ 9:44 am

It’s almost as if a massive-but-temporary spike in federal aid to the states, to get them through the worst of a pandemic, despite some inevitable tradeoffs with some inflationary pressures, was a good policy idea all in all.

Comment by ZC Friday, Feb 4, 22 @ 9:53 am

== If Illinois’ cannabis industry were to grow to these levels, annual sales would range from $2.4 billion to $3.8 billion per year. ==

Imagine where sales would be if the state had issued the licenses on time or if litigation was wrapped up.

Comment by just the facts Friday, Feb 4, 22 @ 9:54 am

==What are they gonna say? Hmm? ==

But her emails?

Comment by Socially DIstant Watcher Friday, Feb 4, 22 @ 9:54 am

It’s almost like actual governance matters.

Comment by Blue Bayou Friday, Feb 4, 22 @ 9:57 am

Si, if I understand this correctly reading the numbers…under governor pritzker we have experienced multiple years of increased revenue?

But Rauner and LP told us we had to go all Kansas to get growth. Bailey too.

I am perplexed. We went all Minnesota and it seems to be working. How could that be? /s

Comment by JS Mill Friday, Feb 4, 22 @ 10:01 am

“”What are they gonna say?”

Heard from some solid R’s at the doors:

“What recovery? I don’t see a recovery.”

“Pritzker just got bailed out by the Feds.”

Smart comms people simply amplify what people are already saying.

Comment by walker Friday, Feb 4, 22 @ 10:03 am

=== Smart comms people simply amplify what people are already saying.===

There ya go again, - walker -, ruining all the funny-fun, lol

Happy Friday, and you aren’t wrong, not one bit.

Comment by Oswego Willy Friday, Feb 4, 22 @ 10:06 am

= Smart comms people =

…don’t target failure as their base, and then wonder why they keep failing.

Comment by TheInvisibleMan Friday, Feb 4, 22 @ 10:07 am

That corporate number is just massive. Already more than we would normally get in a year.

Comment by Ok Friday, Feb 4, 22 @ 10:12 am

Wouldn’t worry too much about what Republican voters are telling their electeds in this state, or how they try to spin it. Spelunkers gonna spelunk. This is very good news, obviously, and even more proof we don’t need right wing “reforms.” It would not be their opponents’ failure that the professional doom pushers fear, as much as their success.

Comment by Grandson of Man Friday, Feb 4, 22 @ 10:23 am

Great Receipts!

Great that cannabis sales are up, but for all those taxes cannabis purchasers pay; they’re not getting much back in return as far as actual regulation of the product or the industry.

Comment by 33rd ward Friday, Feb 4, 22 @ 10:33 am

What is the obsession with Kansas JS Mill?

I have never said Illinois should “go all Kansas” to grow our economy although they rank 27th compared to Illinois #48 ranking in terms of best states for business

The states to follow have business friendly regulations and tax structures and are experiencing record population growth like Texas, Florida, Tennessee, North Carolina etc.Your beloved Minnesota is #40

and is also also experiencing population decline

“Overall the state’s population grew by just 225 people in the most recent year, which ran from July 1, 2020, through June 30, 2021. That’s the state’s slowest growth in decades. In 2019, the last full year before the COVID-19 pandemic, Minnesota added 31,291″

https://www.mprnews.org/story/2021/12/21/covid-drives-halt-to-minnesotas-population-growth

https://chiefexecutive.net/2021-best-worst-for-states-business/

Comment by Lucky Pierre Friday, Feb 4, 22 @ 10:33 am

=they’re not getting much back in return=

I beg to differ. They are getting some really high quality maryjane. Really high quality, and it is legal. That is more than enough.

Comment by JS Mill Friday, Feb 4, 22 @ 10:40 am

I hear the naysayers saying this is all made up numbers, wait until the sky falls, still doesn’t solve the pension debt.

Comment by illinifan Friday, Feb 4, 22 @ 10:41 am

JS Mill +1

However, the administration of that program leaves a whole lot to be desired.

Comment by Rich Miller Friday, Feb 4, 22 @ 10:42 am

And all the good news without revamping the tax structure

Comment by Sue Friday, Feb 4, 22 @ 10:45 am

== they’re not getting much back in return ==

Not being arrested and having a criminal record is priceless.

I’d pay double the tax and still wouldn’t care.

Comment by TheInvisibleMan Friday, Feb 4, 22 @ 10:45 am

===…without revamping the tax structure===

The 3% are just giddy about that, lol

Comment by Oswego Willy Friday, Feb 4, 22 @ 10:46 am

let’s continue with the good news..looks like lower taxes(permanently) in the future.

Comment by Blue Dog Friday, Feb 4, 22 @ 10:47 am

=== Really high quality, and it is legal. That is more than enough. ===

I keep hearing people say “if they don’t cut these taxes and drop the prices soon, people are gonna stop going to the dispensary and hit up their local dealer! They’ll do it any day now!”, yet there’s always a line at my local dispensary. I’ve never had product this good in the past.

It’s no different than how everybody who drinks also knows a buddy who brews their own beer, yet Binny’s still does a very brisk business because people like a quality product at a reasonable price.

=== However, the administration of that program leaves a whole lot to be desired. ===

No doubt, and that’s a very noticeable mark on an otherwise fairly successful rollout of this program.

Comment by Leap Day William Friday, Feb 4, 22 @ 10:54 am

=== let’s continue with the good news..looks like lower taxes(permanently) in the future. ===

Why is this always something people want? The constant up and down of taxes makes no sense. Why not just keep the taxes where they are and make better investments in our state such that we permanently stay out of the hole we are digging ourselves from? Seems to work pretty well in Minnesota…

Comment by Leap Day William Friday, Feb 4, 22 @ 10:56 am

===looks like lower taxes(permanently) in the future.===

Maybe, after $130B in taxes for the pensions are collected…

Comment by Jibba Friday, Feb 4, 22 @ 10:56 am

“not getting much back in return”

Spoken from someone who obviously never bought weed pre-legalization.

Comment by Flyin' Elvis'-Utah Chapter Friday, Feb 4, 22 @ 10:57 am

All this discussion is inspiring me to go out and buy some cannabis.

Full disclosure: first consumed over 50 years ago. Can confirm that the dispensary stuff is high quality.

Comment by Friendly Bob Adams Friday, Feb 4, 22 @ 11:15 am

I wonder how much of the corporate income tax growth is due to the tax increases from last year that were timing in nature. Should be some slight reversal of that dynamic in 2022 and 2023, with 2024 where it will be more pronounced.

Comment by crockett Friday, Feb 4, 22 @ 11:31 am

If only the progressive income tax would have passed. More bills would have been paid, more programs funded, more state level property tax rebates, maybe even more dollars to fight crime.

But Griffin would be paying more…

Comment by Cool Papa Bell Friday, Feb 4, 22 @ 11:43 am

=However, the administration of that program leaves a whole lot to be desired.=

So much. I was in Michigan a couple of weeks ago - remember, they legalized on the same date - and the local dispensary was running a special, get 3 1g vape cartridges and 5 pre-rolls for $100. And that included delivery.

I don’t know what the total for that would be here, but it would be in excess of $300 and you’d have to go pick it up

Comment by Joe Bidenopolous Friday, Feb 4, 22 @ 11:48 am

…And so we are left with Durkin complaining about TONE and Irvin walking out of an interview…

That’s what the GOP is offering right now as an alternative?

Comment by Cool Papa Bell Friday, Feb 4, 22 @ 11:48 am

> If only the progressive income tax would have passed. More bills would have been paid, more programs funded, more state level property tax rebates, maybe even more dollars to fight crime.

If it passed, we could be talking about lowering income taxes for a significant portion of the public.

Comment by supplied_demand Friday, Feb 4, 22 @ 12:03 pm

Therefore there are so https://www.bestcustomwriting.com/personal-statement-help of them available

Comment by Jack Scott Friday, Feb 4, 22 @ 12:26 pm

Again, what was the reason(s) that marijuana can’t be retailed like liquor? In Illinois it seems to be a cross blend of local Prohibition, monopoly, and / or oligopoly. With higher prices than a retail liquor model would have.

Comment by Anyone Remember Friday, Feb 4, 22 @ 12:30 pm

In other news, in 2021 Illinois had nearly 200,000 business startups, #1 in the Midwest and #6 nationally.

https://www2.illinois.gov/dceo/Media/PressReleases/Pages/PR20220204.aspx

Comment by White Dynamite Friday, Feb 4, 22 @ 1:32 pm

You mean “Illegal marijuana sales”, since marijuana is still illegal under Federal law. Tired of hearing that “it’s legal” when it isn’t. DEA could shut down every “legal” dealer and grower and get convictions on Federal charges, because State may not ignore or nullify Federal law. This is why some banks and other businesses don’t deal with the “legal” marijuana industry; their lawyers know not to be caught with money of criminal enterprises or funding said enterprises. But hey, it’s taxed, so it’s all good, right??

Comment by thisjustinagain Friday, Feb 4, 22 @ 1:33 pm

==Tired of hearing that “it’s legal” when it isn’t.==

Brought to you by the same tired folks who are still against legalization of marijuana.

Comment by Demoralized Friday, Feb 4, 22 @ 1:43 pm

=Tired of hearing that “it’s legal” when it isn’t=

States rights and small government.

It is “legal”in Illinois. The state will not prosecute. Let me know when the DEA closes down a dispensary.

Comment by JS Mill Friday, Feb 4, 22 @ 2:20 pm

===Maybe, after $130B in taxes for the pensions are collected===

That is $5.6B per year. Not horrible for a $45B budget, and not horrible after decades of underfunding.

Comment by thechampaignlife Friday, Feb 4, 22 @ 2:52 pm

Match check champaign, you must be at Kams

the reality is very different

The $8.6 billion pension payment in FY 2021 was 20 percent of the state’s $42.9 billion General Revenue Fund budget, and pensions are routinely the state’s largest GRF expense outside of K-12 education. In fiscal year 2022, COGFA estimated the GRF payment at $9.4 billion, or over 21 percent of the operating budget.

FY 2023’s Edgar Ramp-mandated GRF payment is estimated at more than $9.6 billion, or nearly $10.8 billion including other state funds.

But, according to the report, if the state wants to contribute at a rate approved by actuaries, it will need to contribute nearly $14.9 billion in FY 2023, which begins July 1, or 38 percent higher than what is provided for via the Edgar Ramp.

https://www.sj-r.com/story/news/politics/government/2021/12/10/report-good-illinois-pension-news-doesnt-reduce-financial-pressures/6461027001/

Comment by Lucky Pierre Friday, Feb 4, 22 @ 3:40 pm

These are remarkable numbers. Really impressive level of economic activity.

“It’s all a gimmick.”

Nope. It’s just math.

Comment by New Day Friday, Feb 4, 22 @ 3:49 pm

- Lucky Pierre -

So this is … still… bad news?

Also…

=== “Overall the state’s population grew by just 225 people in the most recent year, which ran from July 1, 2020, through June 30, 2021. That’s the state’s slowest growth in decades. In 2019, the last full year before the COVID-19 pandemic, Minnesota added 31,291″===

So now it’s not “people leaving”… but this.

You must be a treat at parties… spelunking for misery, lol

Comment by Oswego Willy Friday, Feb 4, 22 @ 3:52 pm

LP

I’m guessing you could get a job at IPI with your constant bellyaching about pensions. They can always use another pension hater over there.

Comment by Demoralized Friday, Feb 4, 22 @ 4:01 pm

I have plenty of friends of all political stripes OW but thanks for the concern

How about we just stick with that facts instead of putting words in other people’s mouths and trying to gaslight everyone about how Minnesota is a progressive paradise

Comment by Lucky Pierre Friday, Feb 4, 22 @ 4:51 pm

===How about we just stick with that facts===

Now who’s gaslighting?

Comment by Oswego Willy Friday, Feb 4, 22 @ 4:58 pm