Latest Post | Last 10 Posts | Archives

Previous Post: Speaker Welch again says anti-crime measures high on House priority list

Next Post: COVID-19 roundup

Posted in:

* The State Actuary issued a report on December 22nd entitled “Actuarial Assumptions and Valuations of the State-Funded Retirement Systems.” Yeah, I didn’t read it, either.

But one of my very smart readers did go through it and reached out to me yesterday…

Hi Rich,

Long time follower, first time writer. In full disclosure, I recently retired from the [redacted] after more than [redacted] years. I just read the COGFA article today and was encouraged about the State’s finances yet again.

Another report that came out in late December that received no coverage was the State Actuary Report (see link below). The unheralded news in this report was that there were several State pension systems that passed the “Tread Water” point in FY21; meaning we are now paying in more than we owe and reducing the liability for those systems.

* From the report…

One of the persistent sources of the increase in unfunded actuarial liability [UAL] is due to actual contributions to the System being less than the tread water contribution (the amount needed to prevent the unfunded actuarial liability from increasing if all assumptions are met). Actual contributions have been significantly less than the tread water cost. Each year that total contributions remain below the tread water cost, the unfunded actuarial liability is expected to grow. […]

Contributions that are less than the tread water contribution causes the UAL to increase. The tread water contribution consists of two components: the normal cost, which is the cost of benefits earned in a given year, and the interest on the unfunded actuarial liability. This sum is referred to as the tread water contribution because it is the contribution necessary so that the UAL will remain constant, or “tread water” (absent experience gains or losses). The difference between actual contributions and the tread water contributions have increased the UAL by $4.71 billion [between June 30, 2011 to June 30, 2021].

Get that? It’s like paying the minimum balance on a credit card.

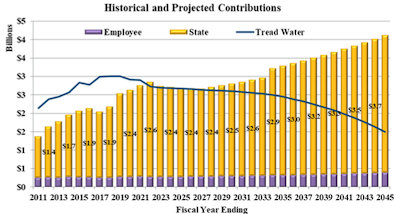

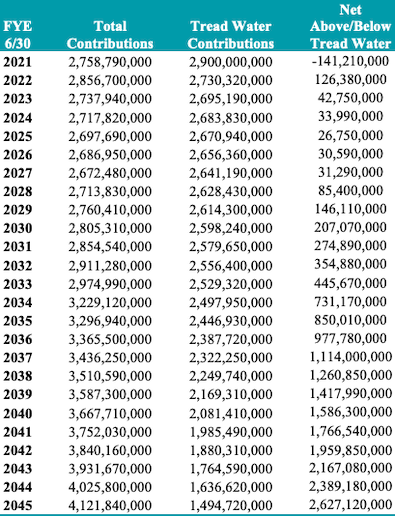

* From the section on the State Employees Retirement System: “As the chart below shows, actual contributions have been significantly less than the tread water cost, however this trend has reversed this year. When the total contributions are above the tread water cost (blue line), the UAL is expected to decline”…

Cool.

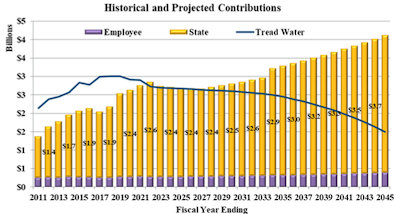

* I called the Auditor General’s office yesterday and asked for the SERS chart’s underlying numbers. They sent along a spread sheet and I plugged in the net above/below numbers…

* Caveat…

Future results may differ significantly from the projections presented here due to such factors as the following: plan experience differing from that anticipated by the assumptions; changes in assumptions; and changes in plan provisions or applicable law.

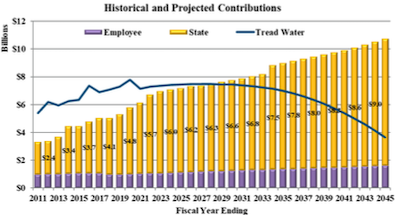

* Back to the report. Here’s where the other state pension funds stand in relation to breaking through the “tread water” mark…

General Assembly Retirement System: 2017

Judges Retirement System: 2021

State Universities Retirement System: 2025

Teachers Retirement System: 2028

* TRS, by far the largest state pension fund, is really close right now…

posted by Rich Miller

Thursday, Jan 13, 22 @ 1:52 pm

Sorry, comments are closed at this time.

Previous Post: Speaker Welch again says anti-crime measures high on House priority list

Next Post: COVID-19 roundup

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

The ramp is working.

I knew SERS was supposed hit the breakeven point this year or in 2023. Earlier is good.

Comment by RNUG Thursday, Jan 13, 22 @ 2:07 pm

Truly terrible, awful news…

… for IPI, Wirepoints, Kass, Proft, Statehouse Chick… all grifters…

Comment by Oswego Willy Thursday, Jan 13, 22 @ 2:08 pm

Thank God for Pat Quinn and his Pension Python leading the charge on this. What was the name of that snake again ??

Comment by Helm Thursday, Jan 13, 22 @ 2:17 pm

“The ramp is working.”

Gov. Edgar is a good person. He is from a different era.

The bad news keeps coming for the usual debt scolds, and good news for us, our finances and future outlook. It’s nice to see examples come in to bolster our state funding priorities, and to refute those who want a different ideological model for this state.

Comment by Grandson of Man Thursday, Jan 13, 22 @ 2:17 pm

Expect the “the pension debt is beyond the point of no return and will be impossible to pay” crowd to escalate their calls to welch on state pension obligations. Any good news on the pension front is bad for their dreams to short public employees. Once the funded ratios start climbing, their sky is falling cry will lose effectiveness.

Comment by Ole' Nelson Thursday, Jan 13, 22 @ 2:17 pm

We really need more of this. I’ve gone blue in the face trying to explain how actuarial timelines work to some people.

The amount of people who have fallen for the “Illinois is bankrupt”, or “insolvent” is only showing how atrocious any type of math beyond grade school is for most people.

I quickly realized that in order to have a meaningful discussion on this with most people, I would have to take a few steps back first to explain the concepts. Then I realized I had to take a few more steps back to explain the concepts of the concepts. Eventually I found myself trying to describe the simplest of math behind amortization. Of course, none of that lack of understanding was preventing anyone from making doom-and-gloom pronouncements based on math they clearly did not understand. It was just a coincidence it sounded exactly like the opinions certain policy institutes were publishing.

Now that these numbers are out, it should take what… about another week before that dull wire place puts out another article about how the only solution for the state is bankruptcy. Oh, and maybe it will help if we completely gut public funding on stuff too.

Comment by TheInvisibleMan Thursday, Jan 13, 22 @ 2:19 pm

===The ramp is working.===

Just because it works doesn’t mean it is or was the best policy approach or ever was the best policy approach. The “pension ramp” did exactly what it was supposed to do — it kicked the actual cost of government down the road so that future taxpayers can pick up the tab for public goods or public services that the state never paid the total cost for when they were provided.

The ramp wouldn’t need to exist if the body politic and the officials elected after the new constitution was enacted had been disciplined enough or cared enough for the future of the State of Illinois to levy enough taxes to be able to fully fund the pensions of public employees. Everyone knew what they were doing when they did it, they just pretended like it was going to be okay because magical growth was going to absorb all of the additional payments, and some how refusing to tax people enough to pay for the services they were getting was going to help spur that growth.

Yes. The ramp is working, but it’s working because people who weren’t alive or were children are picking up the tab for people too cheap to pay for the services they got so long as they could screw someone else — and since 100% of federally taxed retirement is excluded from Illinois income tax the folks that benefited the most from this policy get to run out on the check instead of contributing to their share of the debt we amassed because they were unwilling to support policies that raised an adequate amount of revenue.

For people who expect to be alive in 2045 this isn’t a victory lap. It’s a reminder that there was an all out assault on your future by your parents, grand parents, and great grand parents, so not only do you get to deal with their inability to address pollution and desire to drive big vehicles, you get to deal with the pension debt they ran up too.

Comment by Candy Dogood Thursday, Jan 13, 22 @ 2:24 pm

As an aside and alone,

To the emailer to Rich,

Good eye, thanks for sharing. The more knowledge that is passed the better… and thanks, Rich, for bringing it to full sunshine here. This place is unique to the inside baseball importance to seeing how governing is going.

Cool post. Good stuff.

Comment by Oswego Willy Thursday, Jan 13, 22 @ 2:25 pm

Helm - Thursday, Jan 13, 22 @ 2:17 pm:

Thank God for Pat Quinn and his Pension Python leading the charge on this. What was the name of that snake again ??

————————————————

Squeezy The Pension Python I believe!

Comment by In the know Thursday, Jan 13, 22 @ 2:27 pm

Yikes. We’d better get a fair tax initiative on the ballot.

Comment by Birds on the Bat Thursday, Jan 13, 22 @ 2:30 pm

The ramp is not working. TIER 2 and investment returns are working. The ramp is still horrible policy.

Comment by Frisco Thursday, Jan 13, 22 @ 2:31 pm

- Frisco -

IPI and Wirepoints are down the dial, fair warning, each will ask if you’d like to make a donation or get in a mailing list…

The chart above seems to disagree with your thought.

Comment by Oswego Willy Thursday, Jan 13, 22 @ 2:33 pm

Good news. Now we’ll see how IPI and it’s ilk spin this into a world ending disaster.

Comment by Norseman Thursday, Jan 13, 22 @ 2:35 pm

- Birds on the Bat -

Did you vote against the Fair Tax because you felt the Edgar Ramp was working?

I don’t recall you saying pensions were doing well in the ramping phase.

Comment by Oswego Willy Thursday, Jan 13, 22 @ 2:36 pm

===The ramp is not working. TIER 2 and investment returns are working. ===

The ramp is working BECAUSE of tier 2 and investment returns.

Comment by Candy Dogood Thursday, Jan 13, 22 @ 2:37 pm

===The ramp is not working. TIER 2 and investment returns are working. The ramp is still horrible policy.===

The ramp is doing exactly what it was supposed to do. Increase contributions in the out years to get to the final percentage funded destination. Tier 2 and investments certainly have helped. The issue many have with the ramp is that as the contributions increase less money is available for GRF (spending). Is this all a good thing? The eye is in the beholder. I personally like that the system is above the tread water level. Think of the contributions above the tread water level like a rainy-day fund against future drops in the investment returns. As long as the GA doesn’t look at contributions above the tread water level as a piggybank, things will be good.

Comment by Nagidam Thursday, Jan 13, 22 @ 2:46 pm

=Yikes. We’d better get a fair tax initiative on the ballot.=

Happy to knock on doors for you if you are going to start the campaign back up. I mean, imagine how much interest we would save if your overlord, Ken Griffin, paid a bit more in state taxes.

=The ramp is not working. TIER 2 and investment returns are working. =

Facts to the contrary and all.

Comment by JS Mill Thursday, Jan 13, 22 @ 2:53 pm

Great news.

I do have a grim question about overall pension obligations. And this is grim. Is there any indication that the funds are seeing any greater balance now because of fewer participants? Has COVID and its impact on older folks been a factor?

Comment by Cool Papa Bell Thursday, Jan 13, 22 @ 2:56 pm

We’ve got to fix what’s broken. And I’m sure we’re about to hear about all kinds of other broken things that need fixin’. Or maybe we’ll just hear “Madigan.” That’s always a good standby.

Can’t speak for the party, but I’m cool with embracing a solution that was adopted by a Republican governor.

Comment by Pundent Thursday, Jan 13, 22 @ 2:59 pm

IPI and Wirepoints have no pension solutions and are 100% a PR/political messaging group. I just think the ramp was bad policy that led to more bad policy (Tier2). Someone should do the chart for MEABF, FABF, PABF.

Comment by Frisco Thursday, Jan 13, 22 @ 3:01 pm

I’ll split the difference with y’all…. The ramp is working… and it is horrible policy.

Comment by Ducky LaMoore Thursday, Jan 13, 22 @ 3:02 pm

===It’s like paying the minimum balance on a credit card.===

Only if you have stopped spending on the card. In our case, it is like paying the minimum plus whatever you spent that month, so your total balance owed stops growing. Definitely great news, and proof that adults running the ship with sufficient revenues makes all the difference.

If you adjust these contributions for inflation, we will never pay a higher contribution than we are in 2022. Next year we will pay $169M less than this year, then $240M less in 2024 vs. 2022, $308M less in 2025 vs. 2022, etc. This is a huge milestone. Even in nominal, non-adjusted dollars, we do not reach the 2022 amount again until 2031.

I will note that 2034 has a $254M (9%) jump, although that is about $150M adjusted for inflation. Something to be mindful of, but the savings over the next decade should help us meet that increase.

Comment by thechampaignlife Thursday, Jan 13, 22 @ 3:10 pm

== The ramp wouldn’t need to exist if the body politic and the officials elected after the new constitution was enacted had been disciplined enough or cared enough for the future of the State of Illinois to levy enough taxes to be able to fully fund the pensions of public employees. ==

While that is partially correct, retrospect and reading the Con-Con debate notes, the participants at that time thought they had made it idiot proof and the funding would be forced by the 1970 Constitution. In addition, the then new income tax did raise extra funds over the previous tax system; unfortunately the General Assembly spent even faster.

The IL Supreme Court threw the Con-Con delegates a curve ball when the court upheld Walker’s shorting of the pension contributions, saying only that the pensions had to be paid when due but that the State had flexibility in how the pension systems were funded.

And yes, by a number of measures, the ramp was bad policy, but it was what could be enacted … and, even with a number of detours, it is working.

Comment by RNUG Thursday, Jan 13, 22 @ 3:19 pm

===the ramp was bad policy, but it was what could be enacted===

Yep. And they did things like Tier 2 to help fix some of the issues with the ramp.

Comment by Rich Miller Thursday, Jan 13, 22 @ 3:21 pm

Someone send a box of smelling salts to the Crain’s ed board ASAP. They’ve done fainted away.

Don’t expect to read this conflicting narrative in those pages anytime soon. And, anyway, their too busy with sensationalist, click-bait in-kind contributions to political campaigns.

Comment by Moe Berg Thursday, Jan 13, 22 @ 4:06 pm

Won’t Tier 2 have to be fixed? You cannot be in a retirement program that your return from the pension is less than social security?

Comment by Exhausted Teacher Thursday, Jan 13, 22 @ 4:21 pm

Exhausted Teacher,

Yes, For those non-coordinated pension members (paying no SSA contributions), mainly teachers, that has been the consensus opinion all along.

The reduced pension benefits for all Tier-2 members will be less than the contributions+standard returns for those members. The “pension fix” was basically done on the backs of the tier-2 members. It will definitely have to be dealt with at some point, especially for those non-coordinated members. Probably in 10-15 years. But that will be someone else’s problem, just like the ramp.

Comment by Boris Thursday, Jan 13, 22 @ 5:53 pm

Correct, Exhausted Teacher, it cannot violate the Federal safe harbor rules. We are likely going to see changes to tier 2 at some point.

Comment by Ole' Nelson Thursday, Jan 13, 22 @ 6:11 pm

A reason the TRS projection is improving is that tier 2 teachers will have to work until 67 to receive their full pension. Their tier 1 colleagues can retire at 55 after 35 years.

Comment by anon2 Thursday, Jan 13, 22 @ 6:33 pm

Good news on the numbers. How do Districts maintain morale between Tier 2 and the generous pension group? I guess this a lot, such as with young auto workers (if there are any) versus old workers.

Comment by tlm1959 Thursday, Jan 13, 22 @ 11:52 pm

The sooner we get all NEWLY HIRED state employees off of pension programs (Tier II or whatever) and into defined contribution programs, the better. Why would I want to trust my retirement income to a state government/bureaucracy notorious for not paying its bills? Empower these state employees by giving them their retirement funds as their own, not placing those funds inside a pension system to hold and dole out to you every year only to see it disappears after you (or your survivor(s)) are dead and gone.

Comment by Eastern Bloc Gulag Friday, Jan 14, 22 @ 8:29 am

@anon2: ===Their tier 1 colleagues can retire at 55 after 35 years.===

It’s called Rule of 85. So it’s more like…

at age 55 after 30 years, or

at age 51 after 34 years, or

at age 64 after 21 years

And instead of “full” pension, I would say they can start receiving pension payments without early payment penalties or waiting until they’re older.

Comment by From DaZoo Friday, Jan 14, 22 @ 9:42 am

This is of course good news. However, if Tier 2 pensions need to be fixed, do people know how much of this good news is permanent and how much is temporary because it assumes that Tier 2 will not be fixed?

Comment by Student Friday, Jan 14, 22 @ 12:37 pm