Latest Post | Last 10 Posts | Archives

Previous Post: SoS finally changes its goofy website name

Next Post: COVID-19 roundup: Illinois’ languishing senior vax rate; DeVore gets it wrong; Anti-vaxxers shout down special needs kids; More HCRCA misinformation; Dueling court rulings

Posted in:

* Institute of Government and Public Affairs…

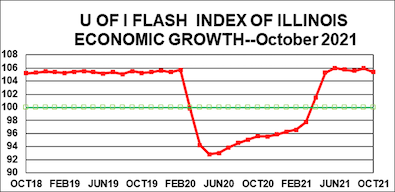

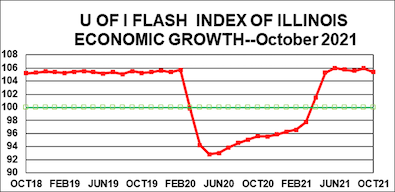

The University of Illinois Flash Index in October fell to 105.4 from its 106.0 level last month. This decline in Illinois followed the broader national pattern of a slowing recovery from the short, but sharp COVID-19 recession of 2020.

The small recovery the index made in September was wiped out, but the reading remains above the 100-level dividing line between economic growth and decline. See the full Flash Index archive.

“This drop is likely the result of the return of some restrictions because of the emergence of the Delta variant, along with supply chain bottlenecks that have slowed the economy,” said University of Illinois economist J. Fred Giertz, who compiles the monthly index for the Institute of Government and Public Affairs. “While the short-term outlook remains clouded, there is still optimism for 2022. This is based on the apparent receding of the Delta variant surge and the strong pent-up demand from consumers whose spending has been limited during the COVID-19 crisis.”

Giertz said that supply chain problems are also expected to ease, although more slowly than anticipated. Growth rate expectations, while still positive, have been tempered somewhat by these recent developments.

The Illinois unemployment rate dropped to 6.8% from last month’s 7.0% level. However, it remains a full two percentage points above the national rate. Inflation-adjusted corporate and sales tax receipts were up from the same month last year, while individual income tax receipts were down. As noted below, these results are impacted by changing payment patterns as well as basic state economic activity.

The Flash Index is a weighted average of Illinois growth rates in corporate earnings, consumer spending and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through October 31, 2021.

Even though more than a year has passed since the beginning of the COVID-19 pandemic, ad hoc adjustments will still be needed for some time because of the timing of the tax receipts resulting from state and Federal changes in payment dates both this year and last year.

* History…

posted by Rich Miller

Monday, Nov 1, 21 @ 10:53 am

Sorry, comments are closed at this time.

Previous Post: SoS finally changes its goofy website name

Next Post: COVID-19 roundup: Illinois’ languishing senior vax rate; DeVore gets it wrong; Anti-vaxxers shout down special needs kids; More HCRCA misinformation; Dueling court rulings

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I wonder how useful the third derivative would be.

It would certainly help put into a picture the sharp events such as what was just experienced in that 16 months.

How fast or slow is the increase or decrease of the increases or decreases in the amount the economic measurements are either increasing or decreasing.

Comment by TheInvisibleMan Monday, Nov 1, 21 @ 12:08 pm