Latest Post | Last 10 Posts | Archives

Previous Post: DoIT does it again

Next Post: Teacher shortage persists

Posted in:

* Press release…

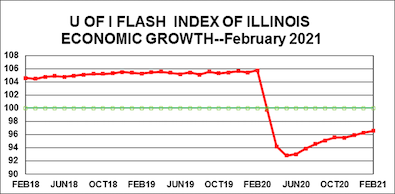

The February University of Illinois Flash Index rose to 96.6 from its 96.3 level in January. Last year’s February 2020 reading of 105.7 was the last reading above the 100-dividing line that indicates growth before the COVID-19 crisis caused the index to plummet to 92.8.

“Although the Flash Index does not predict the future, most signs suggest that both Illinois and the nation are on the verge of a strong economic expansion,” said University of Illinois economist J. Fred Giertz, who compiles the monthly index for the University of Illinois System’s Institute of Government and Public Affairs (IGPA). “The shutdowns and the threat of the virus suppressed demand. The return to near-normal anticipated in the next few months with the availability of various vaccines and the likelihood of additional federal stimulus spending are expected to unleash some of that pent-up demand.”

Like last month, the indicators for Illinois were mixed, with unemployment increasing while tax revenues remained strong. All three components of the index (corporate, individual income and sales tax receipts) exceeded the levels of the same month in 2020 after adjusting for inflation even though last year’s numbers were not impacted by the health emergency.

The Flash Index is normally a weighted average of Illinois growth rates in corporate earnings, consumer spending and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through February 28, 2021. Ad hoc adjustments have been made to deal with the timing of the tax receipts resulting from state and Federal changes in payment dates beginning in March.

* Graph…

posted by Rich Miller

Monday, Mar 1, 21 @ 10:57 am

Sorry, comments are closed at this time.

Previous Post: DoIT does it again

Next Post: Teacher shortage persists

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Models that continue to use unemployment data based on number of filings should be thrown out until the fraud issues are solved. Ohio released a report that 25% of claims in the state are found fraudulent. Colorado had a 63% spike in early January driven by fraud.

Comment by Chicagonk Monday, Mar 1, 21 @ 11:23 am

Remember that Illinois Democrats promised raises to the minimum wage in the midst of a devastating pandemic that pummeled small business would not affect employment negatively.

The minimum wage was raised to $9.25 in January 2020, , $10 on July 1 and now $11 on January 1st and we wonder why our unemployment numbers are so bad.

Comment by Lucky Pierre Monday, Mar 1, 21 @ 11:50 am

Linking this to the minimum wage is hilarious

Comment by Nick Monday, Mar 1, 21 @ 1:11 pm

==Linking this to the minimum wage is hilarious==

Think of it this way, your employer gives you a 12 month temporary pay cut. You’re ticked off but you think you can make it with careful budgeting. A few months in, your cable company, water company, electric company, etc. all conspire to raise your rates 33% because they think you are “too rich” and “need to do your fair share”. What do you think is going to happen to your *personal* economic growth?

How is the State of Illinois any different?

Comment by FranklinCounty Monday, Mar 1, 21 @ 1:33 pm

=== all conspire to===

The smoke is billowing under your dorm room door. Use a towel, and get your popcorn out of the microwave.

“… all conspire to…”

For the love of Pete, lol

Comment by Oswego Willy Monday, Mar 1, 21 @ 1:36 pm

Let the hilarity ensue from the Congressional Budget Office no less:

In an average week in 2025, the year when the minimum wage would reach $15 per hour, 17 million workers whose wages would otherwise be below $15 per hour would be directly affected, and many of the 10 million workers whose wages would otherwise be slightly above that wage rate would also be affected. At that time, the effects on workers and their families would include the following:

Employment would be reduced by 1.4 million workers, or 0.9 percent, according to CBO’s average estimate.

https://www.cbo.gov/system/files/2021-02/56975-Minimum-Wage.pdf

Comment by Lucky Pierre Monday, Mar 1, 21 @ 1:51 pm

Rich,

Any chance you can get gov or IDES to comment on what the current wait time for a call back is? Seems like it has exceeded a month for the past 3-4 weeks.

Asking for a every district office staffer friend.

Comment by Commisar Gritty Monday, Mar 1, 21 @ 2:35 pm

==Linking this to the minimum wage is hilarious==

This. He’s apparently been living under a rock for the past year. Because COVID certainly couldn’t have had an impact, right?

Comment by Demoralized Monday, Mar 1, 21 @ 4:01 pm

Commisar Gritty:

I got a call back in about 5 days when I had a fraud claim.

Comment by Demoralized Monday, Mar 1, 21 @ 4:02 pm

It actually *is* hilarious because we have more than enough evidence now that the link between minimum wage increases and unemployment appears to be, at best… spurious? At least until a point. Studies, real world evidence, there just isn’t huge evidence for job losses. And the CBO report cited uses an *incredibly* ungenerous elasticity that even minimum wage opponents don’t agree with, and even that still shows it naturally being a net benefit (one doubts most of the jobs lost would be in states like Illinois).

But more to the point, do you know who just raised their minimum wage to $11 on the same day that Illinois raised ours to $11? Arkansas. You know who is doing fine? Arkansas.

Comment by Nick Monday, Mar 1, 21 @ 4:02 pm

Covid hit all states but employment is recovering nicely all across America. Illinois remains an outlier.

When will Democrats actually address economic growth and job creation?

Comment by Lucky Pierre Monday, Mar 1, 21 @ 7:06 pm

Illinois ranks 41st in unemployment.

We are at 7.6%

Iowa is 3.1%

Wisconsin is 5.5%

Indiana is 4.3%

Missouri is 5.8%

Minnesota is 4.4%

Michigan is 7.5%

https://www.bls.gov/web/laus/laumstrk.htm

Yet our Governor’s solution seems to be raise taxes and increase regulations on businesses large and small and hope they want to expand here and hire more workers.

That is the joke and it’s not the least bit funny

Comment by Lucky Pierre Monday, Mar 1, 21 @ 11:29 pm