Latest Post | Last 10 Posts | Archives

Previous Post: COVID-19 roundup

Next Post: 10,573 new confirmed and probable cases, 4,409 hospitalized, 857 in ICU, 11.4 percent case positivity, 12.4 percent test positivity

Posted in:

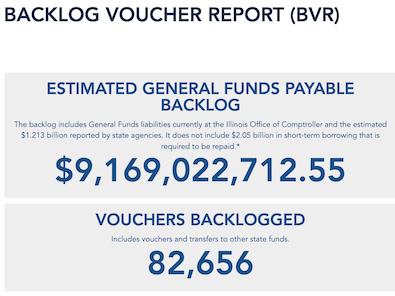

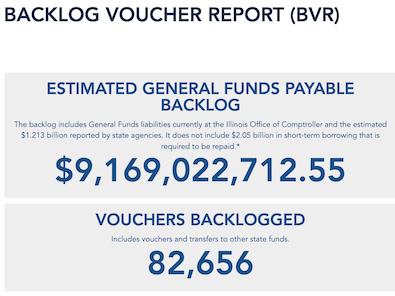

* From the comptroller’s office this morning…

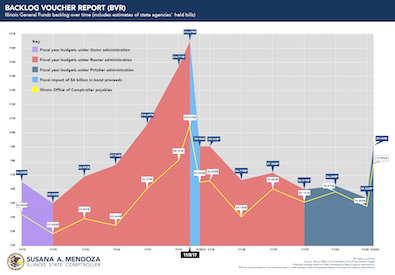

* The trend is not our friend…

Here we go again! Sure glad the governor took full advantage of that once in a lifetime opportunity to pass a graduated income tax!

Oh… wait.

posted by Rich Miller

Monday, Nov 9, 20 @ 11:49 am

Sorry, comments are closed at this time.

Previous Post: COVID-19 roundup

Next Post: 10,573 new confirmed and probable cases, 4,409 hospitalized, 857 in ICU, 11.4 percent case positivity, 12.4 percent test positivity

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

=== Sure glad the governor took full advantage of that once in a lifetime opportunity to pass a graduated income tax===

Why park $50+ million on July 3rd to be not only chasing messaging, not have a baked in message, and allow yourself to get out-hustled?

What was that $50 million doing?

I dunno if you can complain about messaging that was less than truthful against you or monies dumped in to beat you when on… July 3rd… you had both time and cash.

In the end, losing the CA will be the least hurtful, it’s all this “after” and the politics to this after… wow.

Comment by Oswego Willy Monday, Nov 9, 20 @ 11:54 am

Durkin’s plan is to call David Copperfield.

Comment by Precinct Captain Monday, Nov 9, 20 @ 11:54 am

Has anyone seen the state treasurer in the last week…

Comment by NIU Grad Monday, Nov 9, 20 @ 11:58 am

=== Has anyone seen the state treasurer in the last week…===

Mike Frerichs is crouching small as the Frerichs Tax will haunt.

It’s true, Mike Frerichs stands tall to discuss taxing retirement income, the ads don’t need to write themselves, I saw the first salvos.

Thing is… the $50 million plus in July… that tried to marginalize the Frerichs Tax fears… but…

Comment by Oswego Willy Monday, Nov 9, 20 @ 12:03 pm

Even if passed at the rates established the graduated income tax raised just over $3 B. Just goes to show that actually solved nothing and the rates wouldn’t have stayed there long.

Comment by midway gardens Monday, Nov 9, 20 @ 12:04 pm

It’s time for a tax cut[banned punctuation] /s

Comment by Skeptic Monday, Nov 9, 20 @ 12:10 pm

==Durkin’s plan is to call David Copperfield==

Not necessary. As the light blue section informs us, all we need is a bond to make these pesky bills magically disappear.

Comment by City Zen Monday, Nov 9, 20 @ 12:11 pm

i’m sure glad the electorate decided to take advantage of the once in a lifetime gift the GA tried to give them, but alas, they chose a tax hike over a tax cut, coupled with crippling services to poor people, among others.

I just can’t get over it. Everyone’s taxes are going to go up, my taxes are going to go up, because people were scared of OTHER PEOPLE’S taxes going up. Voting against their own self interest

Comment by Perrid Monday, Nov 9, 20 @ 12:37 pm

It takes real courage to extend credit to the state of Illinois in 2020.

Comment by JB' s Tailor Monday, Nov 9, 20 @ 12:43 pm

The vendors to the State of Illinois are once again the lenders of next to last resort.

Coming soon … shorting the vendors of last resort - the 5 State level pension funds.

To be followed by multiple new service taxes and an increased flat income tax rate.

Comment by RNUG Monday, Nov 9, 20 @ 1:12 pm

I can’t imagine doing business with the State of Illinois unless I had no other choices.

Comment by Really Monday, Nov 9, 20 @ 1:17 pm

The people spoke. No new taxes. 55% percent said no. Why are so many unclear on the message?

Comment by Really Monday, Nov 9, 20 @ 1:19 pm

“all we need is a bond to make these pesky bills magically disappear”

Not if IPI and Tillman get their way.

Comment by Huh? Monday, Nov 9, 20 @ 1:20 pm

=== No new taxes.===

They’re coming.

Keep up, please. You said it didn’t matter, you knew your taxes would be raised.

Want me to show you where?

Also, you live in Cook or Chicago, you never responded.

Comment by Oswego Willy Monday, Nov 9, 20 @ 1:21 pm

This is what I wrote to my State Senator and will repeat to my new State Rep.

These are my thoughts regarding the state of Illinois and its budgetary problems. Particularly in light of the defeat of the Graduated Income Tax amendment.

1. All bond issues involving GRF funding that is not self financed to be ceased.

2. No new or expanded programs.

3. ALL Departments/Agencies budgets to be frozen or reduced in a straight % across the board depending upon the state’s tax receipts.

4. No new borrowing unless it is a separate income fund that is self financed.

5. Retraction of the expanded ACA program. Those services NOT Required by Federal law for Medicaid be eliminated. If it takes a federal exemption to do this- do it. Exception to this- if the Federal government pays for any such programs 100%

6. Pass a five year (truly and honestly) Sunseted Services Tax to pay of all past overdue bills. Or pass a similar income tax increase with the same parameters. No gimmmicks. Live within what the present tax rate is and pass a balanced budget. Again, using the aforesaid tax increases to pay back bills.

The Governor and the Democratically controlled GA need to gain some confidence and trust from the citizenry. On taxes they don’t have it which is why the tax proposal was defeated.

Work diligently with the Republican members of the GA to get our house in order. If in the final analysis they are too obstinate, proceed anyway. Remember, this state is controlled by the Democrats and they must show the leadership and final results.

I would be more than willing to travel and talk with you personally about this issue.

Comment by Unconventionalwisdom Monday, Nov 9, 20 @ 1:23 pm

=== five year (truly and honestly) Sunseted Services Tax===

No such thing.

Comment by Rich Miller Monday, Nov 9, 20 @ 1:25 pm

===Retraction of the expanded ACA program. Those services NOT Required by Federal law for Medicaid be eliminated. If it takes a federal exemption to do this- do it. Exception to this- if the Federal government pays for any such programs 100%===

You think there’s 60 and 30 for that?

Pritzker going to sign that during a pandemic?

Comment by Oswego Willy Monday, Nov 9, 20 @ 1:26 pm

Oswego,

My recommendations. Make some of your own rather than just being a constant and boring loudmouth.

Comment by Unconventionalwisdom Monday, Nov 9, 20 @ 1:29 pm

“Retraction of the expanded ACA program”.

The feds pay for 90% of that. You’re going to cut services to over a half million people so the state can save 10% of the value. Jesus, dude.

Comment by Perrid Monday, Nov 9, 20 @ 1:30 pm

“You’re going to cut services to over a half million people so the state can own the libs.”

Fixed it for you.

Comment by Rich Miller Monday, Nov 9, 20 @ 1:32 pm

- Unconventionalwisdom -

1) impossible recommendations are useless.

2) I’ve made clear a saving to higher education, many times, a reorganization savings.

3) you against closing downstate IDOT, DNR facilities, closing a prison. That can happen. Budgets are like that.

4) taxes are going up. How far is up to how bipartisan cuts would like to be… also in concert with how deeps cuts will occur.

Thing is… Rauner showed where the cuts can *only* come… after mandates and statutory and constitutional requirements, the 99th General Assembly showed where pain is, who is actually vulnerable, and where money can be taken without breaking what is required.

Anything else?

Comment by Oswego Willy Monday, Nov 9, 20 @ 1:33 pm

=No new taxes.=

You need a little help with reading and comprehension.

They said no such thing. They said no graduated income tax.

It was a vote to change our system for income taxation. Not a new tax. A change.

Griffin and friends sold it as an increase and then added stories about a retirement tax. They were all untrue and without merit.

So now, everyone pays so Ken Griffin doesn’t have to pay 2 or 3 percent more in state income tax. That is the equivalent in couch cushion money for him. If that.

=Work diligently with the Republican members of the GA to get our house in order.=

THAT is a real knee slapper there. Tell me exactly how you bring the Darren BAiley party to a compromise? There is no such word in their limited lexicon.

Comment by JS Mill Monday, Nov 9, 20 @ 2:17 pm

Dear Unconventional.

As we learned all too painfully during the budget impasse, much of the state’s spending is controlled by court orders and consent decrees, which necessarily prohibits your fantasy of across the board cuts. Unfortunately, cutting or eliminating spending that is not protected by the courts often ends up increasing spending in other parts of the state budget. For example, during the impasse, much of the DCFS budget was secured from the impasse. Dollars flowed to services protected by the courts. And at the same time, the kinds of services that prevent children and families from coming into DCFS went unpaid — things like mental health care, addiction treatment, parenting programs, domestic violence programs, housing supports, child car and after school programs. I could go on. And what is the result? By the end of the budget impasse, the number of calls to the abuse and neglect hotline and the number of children in foster care was rising, and it has never stopped rising. Today, the number of children and youth in foster care is 26% higher than it was at the end of FY17. And just to be clear, the state has both a moral and a legal obligation to care for children who have been abused or neglected. This is just one example of the many ways in which we all pay for failing to support a healthy state government. I am sure there are many many others.

Comment by Andrea Durbin Monday, Nov 9, 20 @ 2:31 pm

Without Covid the fair tax may very well have passed. It wasn’t going to be enough, but would have bought JB some time. We’ll never get to see his full plan implemented now. Would it have worked? Could he have slowed the outmigration of residents and stabilized the fiscal state of the state?

What’s coming next won’t be pretty, especially with the state facing a nasty second wave. JB will be playing defense now.

Comment by SSL Monday, Nov 9, 20 @ 2:42 pm

Really’s comment is evidence of how effective the anti fair tax messaging was. Next time, need to message it as the Tax Cut Amendment.

Comment by filmmaker prof Monday, Nov 9, 20 @ 2:56 pm

The depth of cuts to state agencies will be staggering. It will likely require a good number of layoffs, an ERI, or a combination of both. The hit to services provided by the state agencies will be catastrophic. Buckle up.

Comment by T41 Monday, Nov 9, 20 @ 3:39 pm

DC always seems to have cute names for bills, so I’m proposing the ‘Ken Griffin teacher pension cost shift bill”. Yes let’s dump pension payments on local school districts. Maybe it will reduce the number of districts and save $ on cutting superintendents. And how about the ‘Griffin directional school consolidation Act’. Turn NIU into Central Illinois U and close the four cardinals. The people have spoken!

Comment by Annoyed Monday, Nov 9, 20 @ 3:39 pm

===‘Ken Griffin teacher pension cost shift bill”===

Also known as the 10% property tax hike bill. I don’t think you could get that bill passed even though Speaker. For the record I think the local school districts should be paying teacher pension costs. They set the salaries that should be on the hook for the pensions. What should have happened in the past versus what you can pass are two different things.

Comment by Nagidam Monday, Nov 9, 20 @ 4:05 pm

Friedrich s was truthful and now he’s the goat.

Comment by Bruce Monday, Nov 9, 20 @ 4:28 pm

==Ken Griffin teacher pension cost shift bill==

Would never happen. The teachers unions have a vested interest in keeping retirement costs as far removed from the school districts as possible.

Comment by City Zen Monday, Nov 9, 20 @ 6:20 pm

- City Zen -

You figure out your cost savings yet?

:)

Comment by Oswego Willy Monday, Nov 9, 20 @ 6:22 pm

===Thing is… Rauner showed where the cuts can *only* come… after mandates and statutory and constitutional requirements, the 99th General Assembly showed where pain is, who is actually vulnerable, and where money can be taken without breaking what is required.===

Willy, how long is your hatred of Rauner going to continue? At some point you are going to have to let it go. I didn’t especially like Rauner, but I’m not obsessed with blaming him for everything bad in IL.

Comment by HighSox Monday, Nov 9, 20 @ 8:15 pm

=== how long===

Yeah, I’m gonna stop ya right here, help you with reading comprehension;

=== Rauner showed where the cuts can *only* come… after mandates and statutory and constitutional requirements, the 99th General Assembly showed where pain is, who is actually vulnerable, and where money can be taken without breaking what is required.===

That’s a factual thing that happened… as lawsuits, mandates, and constitutional requirements aren’t “opinions”

If there are words you don’t understand, I’ll help you.

Comment by Oswego Willy Monday, Nov 9, 20 @ 8:18 pm

Oswego Willy,

I live in DuPage County.

JS Mill,

You have to be tone deaf to not get the message the voters sent, but many in the left-islature are. 55% of the voters and 101 of 102 counties said no. The only county in the state that had a majority of voters vote in favor is probably in the worst financial condition of any county in the state. That would be Cook County. They don’t trust their representatives and this was a clear message.

Comment by Really Monday, Nov 9, 20 @ 9:30 pm

=== I live in DuPage County.===

Why do Foxx and Preckwinkle bother you so? They have nothing to do with DuPage.

=== voters and 101 of 102 counties ===

Counties don’t vote. Voters vote.

===They don’t trust their representatives and this was a clear message.===

Now everyone’s taxes are going up.

You are fine with it. You said so. I’ll show you if you forgot.

Comment by Oswego Willy Monday, Nov 9, 20 @ 9:41 pm

Filmmaker Prof,

I understood very well what the amendment meant. And even though it would not have increased our taxes, it gave people I don’t trust the ability to pick and choose whose taxes to raise. It would have been only a matter of time before taxes went up on the middle class. Until pensions are reduced along with state expenditures, I will vote no on new taxes every time they ask my opinion.

Comment by Really Monday, Nov 9, 20 @ 9:46 pm

=== I don’t trust the ability to pick and choose whose taxes to raise.===

So… you voted to raise your taxes anyway.

Boy, you showed them.

You know why I go after your ignorance, you spam this;

=== Until pensions are reduced===

Said and answered to you so very often.

It’s not happening.

What’s owed is owed, there’s no 60/71, 30/36… no governor to sign.

Have you got it yet?

=== I will vote no on new taxes every time they ask my opinion.===

… as you raise your own taxes to own the politicians.

Whew.

Comment by Oswego Willy Monday, Nov 9, 20 @ 9:53 pm

Willy,

We will see if taxes go up. Now they have to raise them on public employees and union members and all people, even the ones that support them politically. I am not sure they have the guts to do it. It would be real dangerous to raise taxes on everyone during a pandemic.

Comment by Really Monday, Nov 9, 20 @ 9:53 pm

=== We will see if taxes go up.===

LOL

There’s not enough revenue. You even admitted you knew they were going up. Stop. K.

=== Now they have to raise them on public employees and union members===

Wirepoints and IPI are down the dial.

Your beef is only to go after state workers and union members.

‘Bout time you were honest. The facade was fun

=== I am not sure they have the guts to do it. It would be real dangerous to raise taxes on everyone during a pandemic.===

Math will dictate it. Another thing you’ve already said too, and said you were fine with happening.

Being the angry guy at pensioners and state workers are raising your taxes to own them. It’s comically sad

Comment by Oswego Willy Monday, Nov 9, 20 @ 9:57 pm

You live in DuPage - Really -

Why the angst at Foxx and Preckwinkle… they have nothing to do with DuPage.

Comment by Oswego Willy Monday, Nov 9, 20 @ 9:58 pm

Willy,

You really are a sore loser. Call me all the names you want but the fact of the matter is that more folks agreed that the Legislature cannot be trusted and they did not want to give them the responsibility written into the CA. No means no.

Comment by Really Monday, Nov 9, 20 @ 10:06 pm

===You really are a sore loser===

I’m actually mocking you. If I’m a loser, how is it both of our taxes are going up?

Like I said, you aren’t as quick in this as you think.

=== No means no.===

When your taxes rise, don’t come back and complain. Sincerely.

lol

Comment by Oswego Willy Monday, Nov 9, 20 @ 10:09 pm

JS Mill,

Not a “new” tax, huh? And that 3.4 billion in “new” funds were just dropping out of the sky, paid for by our imaginary friends. OK, the taxpayers said NO to a change in tax policy. Are you really so dense that you think that meant they want their own taxes raised instead? No means no. They want to see other efforts in tandem to help solve this problem before going to the “we need more money” well for the third or fourth or millionth time in the past decade. Do other things first. Publicize what you have saved, and then maybe ask again. We need a complete solution, not just a democratic one.

Comment by Really Tuesday, Nov 10, 20 @ 5:57 am

=== Publicize what you have saved, and then maybe ask again.===

“Meanwhile, raise everyone’s taxes, including union folks and state workers”

You’re a fool. You’re fooling no one now.

Comment by Oswego Willy Tuesday, Nov 10, 20 @ 6:09 am