Latest Post | Last 10 Posts | Archives

Previous Post: Just had to hold that three-day cornhole tournament

Next Post: 2,630 new cases, 42 additional deaths, 1,679 hospitals, 3.5 percent positivity rate, 6+ million tests conducted to date

Posted in:

* Press release…

The nonpartisan Tax Foundation has released an updated report on Governor J.B. Pritzker’s (D) proposal to permit a graduated-rate income tax in Illinois, which would take effect if voters approve a constitutional amendment on November 3.

If passed, Illinois would have some of the highest individual and corporate income taxes in the country and one of the least competitive overall tax codes, causing the state to decline from 36th to 47th on the State Business Tax Climate Index.

Other findings from the report include:

• Combined corporate income would be taxed at 10.49 percent, the second-highest rate in the nation

• Pass-through business income would be taxed at a top rate of 9.49 percent, the sixth-highest rate in the nation

• The neighboring states of Indiana, Iowa, Kentucky, and Missouri have all cut income taxes in recent years, while Illinois may be headed in the opposite direction

• The proposal diverges sharply from ideal—or even typical—income tax structure by:

o Omitting inflation indexing (resulting in “bracket creep”)

o Creating a marriage penalty

o Imposing a recapture provision which subjects the entirety of a taxpayer’s income to the top marginal rate once they reach that bracket

• Should voters permit a graduated-rate income tax, there’s reason to believe that rates may climb even higher and that more taxpayers would be subjected to higher rates“Were Pritzker’s proposal adopted,” writes Senior Policy Analyst Jared Walczak, “Illinois would trail its peers in just about every aspect of its tax code. If businesses and individuals are leaving the state now, these policies can only make the problem worse.”

The report is here. The full list of the group’s board is here.

* From Quentin Fulks with Vote Yes for Fairness…

It’s not surprising that a group that’s lauded Donald Trump’s corporate tax cuts is against a policy that will fix our broken and unfair tax system that forces hardworking families and struggling small businesses to pay the same tax rate as millionaires and billionaires. It means at least 97% of Illinoisans will receive a tax cut, including more than 95% of small businesses, while generating billions of dollars in additional revenue that can go toward funding our education system and lessening the property tax burden. Currently, thousands of lower-income minority families are fleeing Illinois each year in search of better opportunity, and by passing the Fair Tax we can create a state where they, and all of our families, can thrive.

* Meanwhile…

Illinois does not currently tax retirement income, but there is nothing in the constitution preventing legislators from passing a law to start doing so.

“The myths and lies that are out there about that are obvious of where they’re coming from which are individuals who don’t want to pay their fair share,” [AARP Illinois State Director Bob Gallo] said. “The state could have raised or taxed retirement income all along and they have floated that trial balloon in the past and AARP stopped it in its tracks.”

Gallo said AARP will do the same should anyone instigate discussions about taxing retirement.

He said a graduated tax will help seniors, by helping to get the state on sounder fiscal footing after in recent years having social services that support vulnerable populations get gutted for lack of funding.

* And…

Don Todd, president of the Illinois Alliance for Retried Americans said opponents have “spread lies about the fair tax.” He cited an ad featuring a woman who says she is a grandmother who says she won’t be able to afford to live in Illinois if the amendment passes because it will tax her retirement.

Opposition groups have cited comments made by Treasurer Mike Frerichs last summer to justify their ads suggesting retirement income could be taxed if the amendment is approved. Frerichs told a chamber of commerce that a graduated tax would allow taxation of very high pension incomes. However, he has emphasized he does not support taxing retirement income and Pritzker also opposes it.

Carmen Batances of Chicago, a member of Jane Addams Seniors in Action, said the flat tax “disproportionately harms low income communities of color in Illinois.”

“Many of our children are overtaxed with the flat tax,” she said. “I demand the false advertisements made to scare seniors be taken down immediately.”

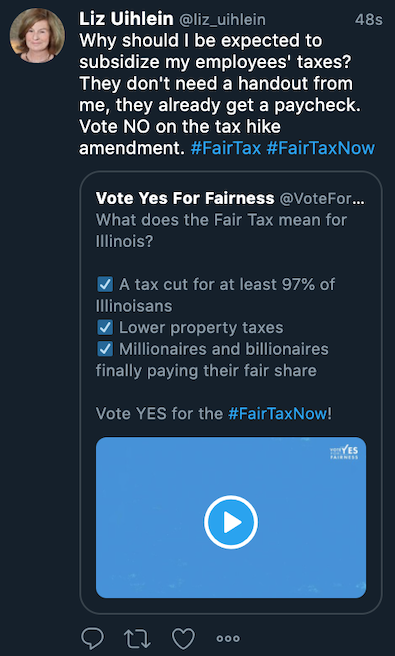

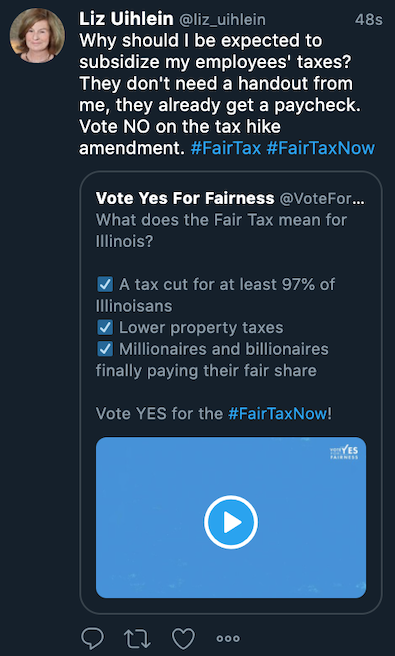

…Adding… The entire @liz_uihlein account has been deleted. This could be a fake. Taking down the screen shot, etc. for now.

…Adding… Institute of Government and Public Affairs press release…

A new report from IGPA, titled How Often Do Graduated and Flat Rate States Change Their Tax Rates?, looks at what other states have done in the recent past.

“The debate over Illinois’ graduated tax proposal made me wonder, do other states change their personal income tax rates frequently?” said report author and IGPA Senior Scholar David Merriman. “It turns out the answer is no, and that goes for states with graduated-rate structures and flat-rate structures. Changes to personal income tax rates just aren’t that common.”

The report considers the personal income tax systems of all U.S. states and the District of Columbia from 2002 through 2019. Merriman, who also chairs IGPA’s Working Group on the Fiscal Health of Illinois, looked at 153 cases of annual tax rate dynamics in states with flat rates taxes and 592 cases of tax rate dynamics in states with graduated rate taxes.

In each year, Merriman examined whether any state tax rate changed. Out of 153 total cases, there were tax rate changes in 27 cases, or 17.76%, in states with a flat-rate tax. In graduated-rate states, out of 592 total cases, there were tax rate changes in 94 cases, or 15.85%. When rate changes were made, rate cuts were much more common than rate increases in both flat- and graduated-rate systems.

The full report is here.

*** UPDATE 1 *** The governor’s campaign folks are going with it…

In a since deleted tweet, Uline President Liz Uihlein announced her opposition to the Fair Tax, calling it a “handout” to her employees. These are the same employees she forced to come into work in a call center at the peak of the Coronavirus pandemic back in March. In the tweet, she expresses concern about having to “subsidize” her employees’ taxes, though her company received up to $18.6 million from the taxpayers of Wisconsin when it moved its facilities there in 2010. The Uihlein family is estimated to be worth $4 billion.

Uihlein’s husband, Richard Uihlein, has donated $100,000 to an organization fighting against the Fair Tax.

This tweet by Uihlein echoes a comment made by another opponent of the Fair Tax a few months ago, when Cindy Neal despicably called low income Illinoisans “takers” and high-income earners “makers” in an interview with WCIA’s Mark Maxwell.

“Opponents of the Fair Tax can try to hide behind millions of dollars in disingenuous ads and false rhetoric, but the truth will always come out,” said Quentin Fulks, Chairman of Vote Yes For Fairness. “Billionaires like Liz Uihlein and Ken Griffin don’t care about our middle and lower-income families. They only care about protecting their bottom line, which is why they’re fighting to stop the Fair Tax, which would make them finally pay their fair share and give a tax cut to 97% of Illinoisans. Time and again, opponents of the Fair Tax have made clear they’re only in it for themselves, and Vote Yes For Fairness is committed to making sure they don’t get away with their deceptive tactics.”

The alleged tweet…

*** UPDATE 2 *** As I suspected…

Rich,

I am writing to you to confirm that the alleged Liz Uihlein tweet that was the subject of your coverage yesterday was a fake account, and that Liz Uihlein has never had a twitter account. After being reported, the fake account has been removed by Twitter for impersonation. We respectfully request that you please remove this coverage of this issue or update it to indicate it was a fake account in no way related to Liz Uihlein.

Thank you,

Ellie–

ELLIE O’NEIL

Mueller Communications LLC

posted by Rich Miller

Wednesday, Oct 7, 20 @ 12:04 pm

Sorry, comments are closed at this time.

Previous Post: Just had to hold that three-day cornhole tournament

Next Post: 2,630 new cases, 42 additional deaths, 1,679 hospitals, 3.5 percent positivity rate, 6+ million tests conducted to date

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

“If passed, Illinois would have some of the highest individual and corporate income taxes in the country”

Don’t threaten me with a good time, bro.

– MrJM

Comment by @misterjayem Wednesday, Oct 7, 20 @ 12:10 pm

I have my doubts once the Graduated Income Tax passes that 97% of taxpayers are actually going to see a tax cut. The standard deductions and exemptions do not reflect market costs and the proposed tax More Tax will not stop the unfairness of the income tax.

Comment by Al Wednesday, Oct 7, 20 @ 12:12 pm

Good to hear what Liz really thinks of the peasants. BTW don’t most of her “employees” live in Wisconsin? I suppose she cold be talking about the help in Lake Forest.

Comment by Pundent Wednesday, Oct 7, 20 @ 12:12 pm

“Let them eat cake”…Liz Uihlein

Comment by Highland Il Wednesday, Oct 7, 20 @ 12:16 pm

Ms. Uihlein’s deleted tweet says all you need to know about how these extremely wealthy Republicans view themselves and the people who work for them. How can anyone who makes under $250,000 even consider not voting for this when it will absolutely be in their interest to do so. Rule of thumb – if a millionaire or billionaire says don’t do this, do it.

Comment by Shytown Wednesday, Oct 7, 20 @ 12:19 pm

“I have my doubts once the Graduated Income Tax passes that 97% of taxpayers are actually going to see a tax cut.”

And the odds of a tax cut for anyone drop to ZERO without the Fair Tax Amendment.

– MrJM

Comment by @misterjayem Wednesday, Oct 7, 20 @ 12:23 pm

The only person AARP should fear is the Treasurer.

Mike Frerichs stands tall to tax retirement income.

To the post,

What’s maybe most important to AARP weighing in, is that AARP can target directly where the retirement income phony needs to go… directed at seniors. That’s huge to the discussion, education on the tax, and executing that education to the audience in a best manner for them to consume, the well-regarded, well-established AARP.

They (AARP) only need to what they do best.

This will help.

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 12:28 pm

I have been thinking about this more since yesterday’s press conference cancellation, but if the amendment fails next month, I would highly anticipate that Frerichs gets a primary for Treasurer in March 2022. From an Administration-backed candidate.

Comment by Chatham Resident Wednesday, Oct 7, 20 @ 12:36 pm

“How can anyone who makes under $250,000 even consider not voting for this when it will absolutely be in their interest to do so”

First if you are married or plan to get married it’s $125,000 not $250,000. Marriage penalty.

Second, JB says this will raise $3.4Bn per year but the FY 2021 budget deficit is ~$7.4Bn. Where’s the additional $4.0Bn coming from? Weed?

Comment by 1st Ward Wednesday, Oct 7, 20 @ 12:46 pm

Illinois Alliance for Retried Americans?

Comment by Cheryl44 Wednesday, Oct 7, 20 @ 12:52 pm

===First if you are married or plan to get married it’s $125,000 not $250,000.===

They can file as individuals, like before they were married.

This is called a “First World Problem”… two individuals, they marry, making $200K+ a piece… how will they make it?

Save the 3%, amirite?

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 12:52 pm

“They can file as individuals, like before they were married.”

And pay more to the feds.

“Save the 3%, amirite?”

Cause the 3% will also shoulder the additional $4Bn to balance this years budget…

Comment by 1st Ward Wednesday, Oct 7, 20 @ 1:00 pm

===They can file as individuals, like before they were married===

The starting point for Illinois tax would be Federal AGI so they would have to file separately for Federal purposes as well; which would reverse certain Federal tax benefits.

Also if Illinois was serious about taxing all income the state would decouple from the Federal code and allow for all the tax free overseas trust income Pritzker gets.

Comment by BulfrogVino Wednesday, Oct 7, 20 @ 1:04 pm

Let’s hear it for the poor rich people?

Comment by Dotnonymous Wednesday, Oct 7, 20 @ 1:06 pm

=== The starting point for Illinois tax would be Federal AGI so they would have to file separately for Federal purposes as well; which would reverse certain Federal tax benefits.===

And?

This is a First World Problem.

How many out of the 3% already categorized is carved out of that 3%?

=== Also if Illinois was serious about taxing all income the state would decouple from the Federal code and allow for all the tax free overseas trust income Pritzker gets.===

Find 71 and 36, so if Pritzker vetoes, they can override.

ILGA.gov has their email addresses.

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 1:08 pm

How do they get to a 9.49% pass through rate? What have I missed?

I expect that rates will have to go up more. This is just a first step.

Comment by Last Bull Moose Wednesday, Oct 7, 20 @ 1:17 pm

Bill Archer? ‘Nuff said!

Comment by Anyone Remember Wednesday, Oct 7, 20 @ 1:27 pm

“How do they get to a 9.49% pass through rate? What have I missed?”

Illinois Personal Property Replacement Tax is added on top of the higher rate getting to 9.49%.

https://www2.illinois.gov/rev/questionsandanswers/Pages/244.aspx

Comment by 1st Ward Wednesday, Oct 7, 20 @ 1:35 pm

“How do they get to a 9.49% pass through rate? What have I missed?”

Personal Property Replacement Tax is in addition to the income tax.

Comment by 1st Ward Wednesday, Oct 7, 20 @ 1:38 pm

The “fair” tax will make it easier to have a discussion on taxing some level of retirement income. I’m not saying that’s bad.

JB is going to have to look at everything pretty soon. Taxing retirement above a certain level, say 100,000, wouldn’t be as hard of a sell.

Can’t do that with a flat tax.

Comment by SSL Wednesday, Oct 7, 20 @ 1:43 pm

The Tax Foundation points listed are correct.

However, nothing in this measure states in any way that retirement income would or would not be taxed. Any statements to the contrary are purposely midleading.

Comment by Unconventionalwisdom Wednesday, Oct 7, 20 @ 1:43 pm

- 1st Ward -

In your assessments, will that increase income taxes outside the 3% the tax is currently seeing the increase?

Thank you.

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 1:46 pm

JB’s budget, even with the new income from this tax, is still around $4 billion in the negative. Illinois should just sax retirement income, which is a form of income, like all other income. To be fair, the people that are now retired were probably the generation that led Illinois down this path in the first place. Big pensions without the taxes to fund them over several decades and now they want to keep their discount.

Comment by OutOfTowner Wednesday, Oct 7, 20 @ 2:03 pm

A right-leaning “pro growth” tax group is against the fair tax? What an unusual turn of events.

Comment by Shytown Wednesday, Oct 7, 20 @ 2:19 pm

Free-market libertarians my bottom. The Uihleins, Griffin, IPI and others like them love having lower income people pay the rich’s share of state income tax. That’s the central theme in the Fair Tax, and now the anti-tax billionaires gave Vote Yes some very good oppo.

Comment by Grandson of Man Wednesday, Oct 7, 20 @ 2:29 pm

=Second, JB says this will raise $3.4Bn per year but the FY 2021 budget deficit is ~$7.4Bn. Where’s the additional $4.0Bn coming from? Weed? =

And where’s it going to come from if this doesn’t pass? Weed?

Comment by JoanP Wednesday, Oct 7, 20 @ 2:31 pm

==Find 71 and 36==

This is called a “First World Problem”

Comment by City Zen Wednesday, Oct 7, 20 @ 2:52 pm

===This is called a “First World Problem” ===

This is called representative government.

Comment by Rich Miller Wednesday, Oct 7, 20 @ 2:54 pm

=== ==Find 71 and 36==

This is called a “First World Problem”===

You can email legislators, ILGA.gov.

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 2:55 pm

“make it easier to have a discussion on taxing some level of retirement income.” You know, they tried the “slippery slope” argument against same-sex marriage, concealed carry and legalized marijuana too.

Comment by Skeptic Wednesday, Oct 7, 20 @ 3:09 pm

OW @ 1:08pm

====How many out of the 3% already categorized is carved out of that 3%?====

Don’t understand your percentages is that the equivalent of “60% of the time it works all the time?”

===Find 71 and 36, so if Pritzker vetoes, they can override.====

So then you are acknowledging that the primary cheerleader, at least financially, of this graduated income tax push has been the benefit of tax avoidance schemes, both Federal and property. And at least on the income tax side he will continue to benefit from his estate tax avoidance schemes.

Comment by BulfrogVino Wednesday, Oct 7, 20 @ 3:27 pm

=== Don’t understand your percentages===

Point of the snark and the exercise is… it’s *still* only the 3% that will be effected.

Slicing, dicing, “what about this, what about them”… it’s *still* the 3% of those paying taxes. The rest is phony splicing to seem thoughtful.

=== So then you are acknowledging that the primary cheerleader, at least financially, of this graduated income tax push has been the benefit of tax avoidance schemes===

No.

No Governor is going to sign it. So, ya better get 71 and 36 if you want it to happen.

Just because you want conspiracies, usually it’s just fundamental politics, nose counting, and realizing how it works in governing.

No real trick here.

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 3:32 pm

=== And at least on the income tax side he will continue to benefit from his estate tax avoidance schemes.===

… and I’m sure you didn’t vote for Rauner as it was found he took two homeowner exemptions.

This is getting to the sad part of trying to be against something that 97% will benefit with its passing.

Do better, please.

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 3:33 pm

OW @3:33

No didn’t vote for Rauner. Just don’t like the hypocrisy. Apparently you can live with it.

Comment by BulfrogVino Wednesday, Oct 7, 20 @ 3:46 pm

=== Apparently you can live with it.===

Making it about me, without making an argument isn’t going to cut it.

Any retort to the points I made?

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 3:49 pm

=Mike Frerichs stands tall to tax retirement income.=

Has he actually said it more than the one time? My recollection is that he suggested that it opens the door for a discussion.

Not exactly a campaign promise showing up on the 6 O’clock news.

Acting like this is something he has is basing the balance of his career in facilitating is a huge leap.

Comment by Go Big Wednesday, Oct 7, 20 @ 4:11 pm

=== Has he actually said it more than the one time?===

Only takes one time, it appears. The likes of IPI, and future opponents, will continue to use it when they can here with the CA and when he runs again.

=== Not exactly a campaign promise showing up on the 6 O’clock news.===

… ‘cept in paid media (ads) that Frerichs might face, next time he runs.

This won’t go away. It’s who he is now.

=== Acting like this is something he has is basing the balance of his career in facilitating is a huge leap.===

Gaffes are like that. They stay with folks in their career.

Mike Frerichs talks about standing tall… like with taxing retirement income.

It’s worth the discussion.

:)

Comment by Oswego Willy Wednesday, Oct 7, 20 @ 4:16 pm

1st Ward. Thanks

Comment by Last Bull Moose Wednesday, Oct 7, 20 @ 4:47 pm

If she really tweeted that, JB should at least send her a nice bouquet to express his thanks.

Comment by MHJ Wednesday, Oct 7, 20 @ 11:38 pm