Latest Post | Last 10 Posts | Archives

Previous Post: 1,298 new cases, 10 additional deaths, 4.0 percent positivity rate

Next Post: Pritzker says he has no intention of giving money to campaign funds controlled by Madigan

Posted in:

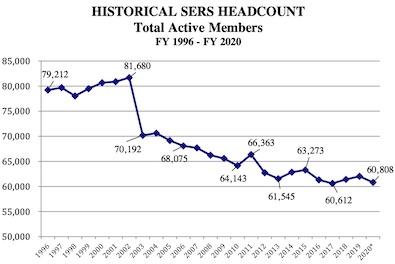

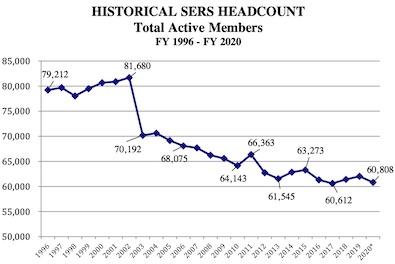

* From COGFA. Headcount…

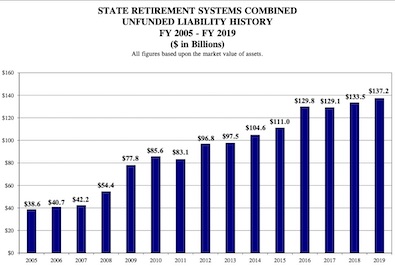

* Unfunded pension liability…

>

>

posted by Rich Miller

Monday, Aug 3, 20 @ 12:41 pm

Sorry, comments are closed at this time.

Previous Post: 1,298 new cases, 10 additional deaths, 4.0 percent positivity rate

Next Post: Pritzker says he has no intention of giving money to campaign funds controlled by Madigan

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Three footnotes to the first chart.

Active members means people actually employed by the State and paying into the pension system.

2002 was the first, very generous Early Retirement Incentive that pretty much got rid of people over age 50.

2004 was a less generous ERI but it also thinned out some older employees that weren’t eligible or didn’t take the 2002 ERI.

Comment by RNUG Monday, Aug 3, 20 @ 12:51 pm

The proverbial double whammy. Less people paying in, more people drawing out. Though, we knew this when the buyouts were offered. We also knew this as Tier 2 was implemented. As always, I believe we underestimated the magnitude of the difference.

Comment by Proud Sucker Monday, Aug 3, 20 @ 12:54 pm

Fast forward 10 years. Actually, we might not need that many.

There is no way out of this mess for the state but people still have choices and they will use them to get out.

Comment by Logical Thinker Monday, Aug 3, 20 @ 12:58 pm

Democrats took total control of Springfield in 2002 and did not pass pro economic growth legislation , quite the contrary.

Comment by Lucky Pierre Monday, Aug 3, 20 @ 12:59 pm

If their allocation was amended to 100% large tech stocks, Moderna, and Wingstop this might be solved….. one can live in fantasy world.

Comment by 1st Ward Monday, Aug 3, 20 @ 1:06 pm

Probably should have noted that, in the past, the State tended to hire in large waves every 10 years or so. Part of what you see is just cyclic in nature as people either reach 35 years or service, age 60, or rule of 85. 2011 - 2013 might have been one of those cyclic dips from the hiring in the late 70’s and early 80’s.

Comment by RNUG Monday, Aug 3, 20 @ 1:10 pm

Maybe we need another hiring surge like there was in the 70s and 80s. Increasing payments into the system will ultimately help the pension balance and we get the benefits of the people working. We need more people working at DHS and IDPH as well as IDES. These would be Tier 2 folks so we improve our economy with taxes, payments to SERS and lower pension payouts later in the process.

Comment by illinifan Monday, Aug 3, 20 @ 1:22 pm

Oldest baby boomers turned 60 in 2010, so that’s probably the 2011 and forward dip, along with slow replacement or no replacement. Not having a budget for a couple years probably didn’t help either.

Picture what the two graphs would look like if people got their way and new employees were not enrolled into a pension system.

Comment by thoughts matter Monday, Aug 3, 20 @ 1:25 pm

Oops. Obviously the oldest boomers turned 60 in 2006, 65 in 2011. Sorry about that.

Comment by thoughts matter Monday, Aug 3, 20 @ 1:33 pm

Vote Yes on the pension Fix amendment, oops I guess there is only the new open ended tax increase amendment

Comment by Curious George Monday, Aug 3, 20 @ 1:34 pm

===pension Fix amendment===

Show me your 71 and 36

===… open ended tax increase amendment===

(Sigh)

Show me the votes to move these outside the 3% paying more, and the governor willing to sign those rate changes.

The millionaire tax is as wise as your choices.

To the post,

The pension liability needs to find a sort of artificial equilibrium while no pension checks are missed and bonding still is the safest for investors as the guarantees are legal to paying back that debt.

These graphs are as alarming as already seen as at the least, at best, worrisome

Comment by Oswego Willy Monday, Aug 3, 20 @ 1:43 pm

You think hiring could be a solution? I hate to inform you but low pay plus tier 2 does not make a long line of people waiting to work for the State of Illinois. Some good jobs are sitting for months to years for applicants.

Comment by Lurker Monday, Aug 3, 20 @ 1:47 pm

Lucky Pierre -

You’re really Rip Van Winkle, and you woke up on Blagojevich’s 2003 inauguration day, correct? /s

Comment by Anyone Remember Monday, Aug 3, 20 @ 1:47 pm

I’m at 75 right now — 10 short of the ‘rule of 85′.

Heck — give me deal — a good deal — and I’ll happily depart for distant shores.

Comment by Mr. K Monday, Aug 3, 20 @ 1:54 pm

The first chart is active SERS employees.

The second is all state retirement systems.

Might be more meaningfull if the second chart reflected only SERS liability.

Or charts broken down for each state retirement system

Comment by Stickman Monday, Aug 3, 20 @ 2:06 pm

@- Curious George - Monday, Aug 3, 20 @ 1:34 pm:

“Vote Yes on the pension Fix amendment, oops I guess there is only the new open ended tax increase amendment”

Ah, you mean the amendment that mandates actually making the necessary payments? You know, sort of like having to actually make interest and principal payments on bonds?

Comment by Hieronymus Monday, Aug 3, 20 @ 2:09 pm

=You think hiring could be a solution? I hate to inform you but low pay plus tier 2 does not make a long line of people waiting to work for the State of Illinois. Some good jobs are sitting for months to years for applicants.=

What do employees pay into SERS? 9%? Then they pay 5ish% in income tax? So for every buck the state pays someone they get 14 cents back? Of course they also get work done. But the work, not the pension contribution is the reason to hire.

Comment by AndyIllini Monday, Aug 3, 20 @ 2:13 pm

Hiring during a period of high unemployment changes the talent pool. It was hard to get talent when unemployment rates were low. Now there are bunch of college grads with no place to go. Taxes paid by workers as well as spending of wages will help the economy. Pension pay in of more workers is a moderate side bonus (not a pension fix).

Comment by illinifan Monday, Aug 3, 20 @ 2:39 pm

I’ll note that the State kind of shot themselves in the foot the past 15 - 20 years in terms of hiring. Lots of job titles were upgraded in terms of the requirements, mostly by requiring specialized or advanced degrees. Prior to that a number of the positions did not even require a college degree of any kind; now a majority do. But while the State was raising the bar on hiring, they didn’t raise the entry salaries to match.

Speaking personally, they updated the job description for the position I had held for over 30 years. During one of my 75 day returns, I was asked to evaluate the new position description. My response was “I don’t even qualify for the job under the new requirements”.

Comment by RNUG Monday, Aug 3, 20 @ 2:49 pm

—

I’ll note that the State kind of shot themselves in the foot the past 15 - 20 years in terms of hiring. Lots of job titles were upgraded in terms of the requirements, mostly by requiring specialized or advanced degrees.

—

I agree — but this kind of thing is needed for technical jobs where the technology evolves. Web development is a good example. Enterprise app development is another example.

25 years ago, I was hired in one job and then promoted to a web developer. Now, the requirements for web dev are so advanced — and so specialized — that I, too — like you — would never qualify for the job I currently hold. I can do the job — and do it well — but one look at my resume would have any hiring manager scratching her head, saying, “Um, why are you in this job exactly?”

Comment by Mr. K Monday, Aug 3, 20 @ 3:25 pm

Ponzi comes to an end when not enough new money to pay off the first “investors”

Comment by 44th Monday, Aug 3, 20 @ 5:00 pm

== Might be more meaningfull if the second chart reflected only SERS liability. ==

On average, you can figure SERS is 24% of the total shown. TRS is 50%, SURS is 24%, and GARS & JRS make up 2%. Charting the individual systems may show some different dips.

Comment by RNUG Monday, Aug 3, 20 @ 6:01 pm

== Ponzi comes to an end when not enough new money to pay off the first “investors” ==

The IL Supreme Court already weighed in on that multiple times. The State to pay the pensions even if the funds go broke.

Comment by RNUG Monday, Aug 3, 20 @ 6:06 pm

A few thoughts:

1) The reduction in headcount probably doesn’t have as much impact on the pension funding as it seems. Two decades ago, there were a lot of people employed in data entry and basic paper form processing. Many of those functions have been replaced by computers and electronic processing. The replaced jobs were largely low income job. The average state employee is now much more skilled and receives much more compensation than in the past. The effect is that the real amount of employee pension contributions probably haven’t dropped as much as you would otherwise expect simply based on the change in headcount.

2) RNUG is correct that skills requirements have gone up without much of an increase in starting level compensation. The State now has real challenges in hiring qualified accountants, attorneys, programmers, etc. The entry level compensation just isn’t enough. Top end compensation is much more competitive, but most people aren’t willing to wait that long.

3) The unfunded pension problem is almost exclusively due to continued underfunding of the pension as opposed to employee contributions. If the State had matched what employees put in, we would have no pension crisis.

Comment by Pelonski Monday, Aug 3, 20 @ 6:07 pm

RNUG, et al., how likely do you think it is that early retirements will be offered in the near-ish future, and how likely do you think it is that the offer will be attractive to the average worker over 50?

Comment by Colin Robinson Monday, Aug 3, 20 @ 6:28 pm

You’d think the unions would pay attention and get to the table. The more the pension payments go up, the less $ there is for head count.

Comment by Contrarian Monday, Aug 3, 20 @ 7:33 pm

RNUG — The IL Supreme Court already weighed in on that multiple times. The State to pay the pensions even if the funds go broke. –

Seriously? No one has ever tested the theory of what happens when the state literally runs out of money. With 30% GDP drop, I’m guessing that test is coming. How do you raise taxes on people who don’t have a job?

Illinifan — Maybe we need another hiring surge like there was in the 70s and 80s. Increasing payments into the system will ultimately help the pension balance and we get the benefits of the people working. We need more people working at DHS and IDPH as well as IDES. These would be Tier 2 folks so we improve our economy with taxes, payments to SERS and lower pension payouts later in the process.– Who pays for these people? And why should the taxpayer’s spend a dollar to save 25 cents?

Comment by Contrarian Monday, Aug 3, 20 @ 7:42 pm

I began working for the state, in corrections, in 1980. The next year was the first of many NO HIRING years. Didn’t mean the work slowed down, just meant that instead of me doing only my job, I was doing another. I don’t know where we are now, but I do know in 2015, we had the lowest amount of state employees per capita than any other state…and it hasn’t got much better. Did the state change criteria…and pay…for some jobs, yes. That was to entice better candidates. But they also annihilated clerical position. I was retired from a professional title, but I was supposed to do filing cuz we had no clerical staff to do it. Oh, BTW, I was paying 9% of EVERY paycheck into the pension, 6.67% into Social Security and a couple hundred into the Deferred Comp.

I still have friends working in Corrections and not only are they working with a COVID issue, but mandatory OT more often than not. We need to HIRE people, get rid of the tier 2 retirement crap(cuz the actuaries have called it a scam) and start acting like adults. We used to have an investigative crew that dealt with fraud with medicaid/welfare fraud and would bring in a good amuount of funds…that’s been decimated since Ryan. No, that money didn’t go to pensions, but it did go to general revenue. If you want functioning government, want to get your FOID cards in a timely manner? How about your elderly relatives getting help for the Dept. of Aging? Or, in this depression, you or your kids get unemployment help? YOU NEED TO HAVE PEOPLE TO PROCESS THE PAPERWORK. If we have more workers, first it helps the economy, second - more money going into the pension funds, third - more services for Illinois citizens. Hopefully, somebody can bring this to the forefront and quit whining about those of us that made less than the private market for years because we valued have a secure retirement.

Comment by Union Thug Gramma Tuesday, Aug 4, 20 @ 1:07 am

=== Seriously? No one has ever tested the theory of what happens when the state literally runs out of money. With 30% GDP drop, I’m guessing that test is coming. How do you raise taxes on people who don’t have a job?===

Seriously? Where wred you during the Rauner years?

The first two years, an entire General Assembly, there was NO budget, literally the state having no budgetary function.

Starving the beast, purposely to ruin Illinois, still pensions were paid.

I dunno what you’re saying. You’d like to see this downturn ruin the state?

Comment by Oswego Willy Tuesday, Aug 4, 20 @ 6:59 am

Contrarian === Seriously? No one has ever tested the theory of what happens when the state literally runs out of money. ===

OW === Seriously? Where wred you during the Rauner years? ===

Thank you, OW, for speaking my mind.

One of the IL-SC cases decades ago, I think, involved unions trying to tell legislators they were Constitionally required to make the full budget appropriations for pension funding. The IL-SC said, “no”, just Constitioinally required to pay pensions. Fast forward to Rauner years and you have court cases of groups of people suing and winning to be paid for various things even though there was no budget. So in some ways there’s your test case.

As to other commentors, the State is definitely overdue on highering more staff. Unfortunately it seems it will continue to be a fire drill approach. Last year’s fire drill was IDCFS. Today’s is IDES and IDPH.

Comment by From DaZoo Tuesday, Aug 4, 20 @ 9:37 am