Capitol Fax.com - Your Illinois News Radar

Latest Post |

Last 10 Posts |

Archives

Previous Post: AFSCME says proper pandemic procedures at IDES “are being followed in most instances”

Next Post: Question of the day

The CTBA has more bad budget news

Posted in:

* From the Center for Tax and Budget Accountability…

Governor Pritzker provided the first estimates of how hard the economic downturn caused by the COVID-19 pandemic will hit Illinois. According to the Governor’s Office of Management and Budget (GOMB), General Fund revenue in the current fiscal year will be at least $2.7 billion less than initial the initial projection of $40.2 billion. That is cause for significant concern, because — as shown in Figure 1, the revenue shortfall amounts to fully 10 percent of what Illinois budgeted to spend on General Fund services this year — where 96 cents of every dollar of such spending goes to the core areas of: education (inclusive of early childhood, k-12, and higher ed); heath care; human services; and public safety.

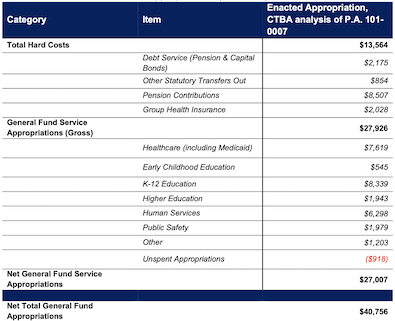

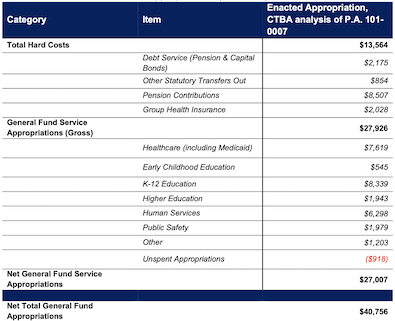

Figure 1: FY 2020 Enacted General Fund Appropriations ($ Millions)

As shown in Figure 1, of the $40.8 billion in total General Fund spending budgeted for FY 2020, $13.6 billion is for “Hard Costs” or mandatory spending obligations over which decision makers have no discretion, because they are required to be paid either by law or contract. Once those Hard Costs are paid — as they have to be — that leaves only $27.01 billion appropriated for services.

Given that there are only two and one-half months left in FY 2020, it would be incredibly difficult to implement a 10 percent cut to core services — especially when considering the increased demand for health and human services caused by the pandemic. [Emphasis added.]

And because only two and a half months remain in the fiscal year, a 10 percent cut to core services for the remainder of FY20 would be the equivalent to a 50 percent or so slash in annual expenditures. Impossible.

* So, that’s why he did this…

(T)he Pritzker Administration has decided to cover over half of the $2.7 billion revenue shortfall now projected for FY 2020 by incurring $1.2 billion in new short-term borrowing plus deferring $400 million in investment fund repayments from FY 2020 into FY 2021, while transferring $323 million via interfund borrowing.

* But…

The bad news is the pandemic’s impact on the economy and hence state revenues is not limited to FY 2020. Governor Pritzker also announced that revenue projections for FY 2021 have been revised downward by $4.6 billion, which, when coupled with repayment of the $1.2 billion in new short-term borrowing that will be incurred this year, plus the deferral of $400 million in repayments that were due in FY 2020 into FY 2021, will drive the total revenue shortfall for FY 2021 up to around $6.2 billion.

And that hole will be $7.4 billion without passage of the graduated income tax, which, the CTBA points out “is almost 36 percent of the current year’s General Fund appropriations for the core services of education, health care, social services and public safety.”

Whew.

posted by Rich Miller

Friday, Apr 17, 20 @ 12:45 pm

Comments

Add a comment

Sorry, comments are closed at this time.

Previous Post: AFSCME says proper pandemic procedures at IDES “are being followed in most instances”

Next Post: Question of the day

Last 10 posts:

more Posts (Archives)

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Just spit-balling here, but I am gessing a Pension Holiday is coming our way.

Comment by Al Friday, Apr 17, 20 @ 12:49 pm

===a Pension Holiday is coming===

The best time for that was before the crash. lol

Comment by Rich Miller Friday, Apr 17, 20 @ 12:50 pm

===The best time for that was before the crash. lol===

Ya we are all getting our quarterly financial statements. They ain’t good.

Comment by Nagidam Friday, Apr 17, 20 @ 12:53 pm

How about another cut to the LGDF. Is that possible, or workable?

Comment by TheInvisibleMan Friday, Apr 17, 20 @ 12:59 pm

While everyone knew that it was going to be difficult before the virus hit, the after is worse than anyone predicted it would get, because it was a normal recession that was feared. We now have a generational event and all bets are off.

A big part of this is what will the Feds deliver in terms of assistance. Several billion would go a long way. This may also be an opportunity to introduce some new revenue streams that had been considered toxic in the past. Perhaps taxing retirement income above a certain level? Perhaps an even more fair progressive tax, with additional brackets at the high end. Could these be introduced as necessary to preserve the state in the post virus world?

Who knows, but it will be necessary to sharpen pencils and be brave.

Comment by SSL Friday, Apr 17, 20 @ 1:00 pm

better get that CHEEECOWGO casino rolling

Comment by Annonin Friday, Apr 17, 20 @ 1:03 pm

The states are going to need a bailout from the Federal Government. Who knows what the Trump administration will do though.

Comment by The Dude Abides Friday, Apr 17, 20 @ 1:29 pm

==a bailout from the Federal Government.===

Sen. Tom Cotton (R-AR) was already screaming about those wastrels in Illinois during the last round of bailout negotiations. I see lots of opposition from red states, unless their budgets explode, too. And it will also likely need a different President first.

Comment by Jibba Friday, Apr 17, 20 @ 1:44 pm

===unless their budgets explode, too===

Ain’t nobody immune from this.

Comment by Rich Miller Friday, Apr 17, 20 @ 1:50 pm

a bailout from the Federal Government

Yeah get in line

Comment by Donnie Elgin Friday, Apr 17, 20 @ 1:52 pm

===unless their budgets explode, too===

This is a global pandemic.

You think the state of Arkansas will fare better overall?

Thinking “locally” about this in government financial budgeting… That won’t work. It’s huge.

Comment by Oswego Willy Friday, Apr 17, 20 @ 1:55 pm

A Trump led federal Bailout will triage the states - Illinois would get Palliative care.

Comment by Donnie Elgin Friday, Apr 17, 20 @ 2:15 pm

JB killed us with this nationalistic approach

Comment by ANON Friday, Apr 17, 20 @ 2:23 pm

==almost 36 percent of the current year’s General Fund appropriations for the core service==

Strange that CTBA didn’t emphasize the percentage shortage with the passage of the graduated income tax.

It’s 30 percent

Comment by City Zen Friday, Apr 17, 20 @ 2:49 pm

“Illinois would get Palliative care”

No. tramp will preemptively pull the plug.

Comment by Huh? Friday, Apr 17, 20 @ 3:32 pm

I wonder how other funds are doing, such as the Road Funds, which depends on MFT revenues. Am guessing it is taking a beating like everything else.

Comment by Huh? Friday, Apr 17, 20 @ 3:34 pm