Latest Post | Last 10 Posts | Archives

Previous Post: More Tribune staff take buyout, including Greg Kot

Next Post: Former Legislative Inspector General says report of “serious wrongdoing” was “squashed” by the Legislative Ethics Commission

Posted in:

* Shruti Singh at Bloomberg…

The forces that are driving the municipal-bond market rally are especially strong in Illinois.

Over the next 30 days, agencies in the state will pay off about $1.3 billion of debt, more than eight times as much as is currently scheduled to be sold, according to data compiled by Bloomberg. While that gap may narrow as more bond offerings are announced, nowhere except Texas currently faces as large a mismatch between supply and demand. That’s a positive sign for Illinois debt, which this year has already outperformed every other U.S. state tracked by Bloomberg as rock-bottom interest rates cause investors to snap up higher-yielding bonds. […]

The broader rally has cut municipal-debt yields to the lowest in more than six decades, fueling interest in bonds with higher payouts. That has helped fuel the outperformance for Illinois, whose rating three years ago was at risk of being cut to junk because of the government’s large debt to employee pension funds and the gridlock the former Republican governor encountered in the Democrat-controlled legislature.

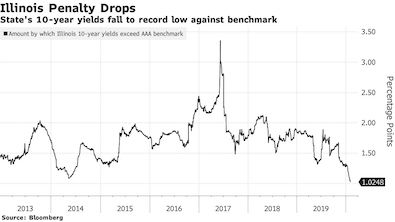

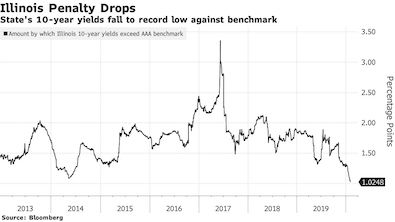

The end to the political divide since Democratic Governor J.B. Pritzker took office last year has also contributed to the state’s outsize gains. The difference between the yields on Illinois’s 10-year bonds and those with the highest credit ratings — a key measure of the perceived risk — has narrowed to a little over one percentage point, the smallest since at least 2013 and down from more than three percentage points in 2017 at the height of a long-running impasse over the budget, according to data compiled by Bloomberg. The yield-penalty on Illinois bonds is still the highest of the 20 states tracked by Bloomberg.

Market conditions are driving most of this, but the state wouldn’t be able to take full advantage of those market conditions if we still had a Tribune-endorsed government stalemate.

* Accompanying graph…

posted by Rich Miller

Thursday, Feb 6, 20 @ 10:29 am

Sorry, comments are closed at this time.

Previous Post: More Tribune staff take buyout, including Greg Kot

Next Post: Former Legislative Inspector General says report of “serious wrongdoing” was “squashed” by the Legislative Ethics Commission

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Hmm, maybe paying bills on time is a good thing, who would have thunk it?

Comment by SpfdNewb Thursday, Feb 6, 20 @ 10:40 am

“…yield-penalty on Illinois bonds is still the highest of the 20 states tracked by Bloomberg.”

As when measuring barometric pressure, it’s helpful to know if the numbers are relative or absolute.

Comment by City Zen Thursday, Feb 6, 20 @ 10:48 am

Translation: We’re paying an interest rate that is higher than we need to be or should be because the credit rating assigned to us is not representative of the risk bond holders actually face.

Comment by Candy Dogood Thursday, Feb 6, 20 @ 10:49 am

Glad for the move in the right direction, but these bonds are relatively more attractive for a number of reasons - including technical market factors rather than fundamentals (credit risk, default risk, interest rate risk), IL bonds are still some of the lowest rated at BBB- (S&P)

“Even so, Illinois’s returns have been driven more by the broader dearth of new bonds than by the government’s fiscal health, said Dan Solender, head of municipal securities investments at Lord Abbett & Co.”

Comment by Donnie Elgin Thursday, Feb 6, 20 @ 10:50 am

we are paying higher property taxes on bonds because of this. Perhaps the State needs to come up with a way to reduce that burden on tax payers.

Comment by frustrated GOP Thursday, Feb 6, 20 @ 11:32 am

“Hmm, maybe paying bills on time is a good thing, who would have thunk it?”

They don’t teach that in Harvard.

Comment by bhartbanjo Thursday, Feb 6, 20 @ 11:55 am

===the gridlock the former Republican governor encountered in the Democrat-controlled legislature===

Let’s just fix that: “the gridlock the former Republican governor created in the Democrat-controlled legislature”

Comment by Nick Name Thursday, Feb 6, 20 @ 11:57 am

=== ===the gridlock the former Republican governor encountered in the Democrat-controlled legislature===

I think The Owl said it best, hooting from the tweeters, making clear how it was going down;

“I’m frustrated too but taking steps to reform Illinois is more important than a short term budget stalemate”

Questions?

Comment by Oswego Willy Thursday, Feb 6, 20 @ 12:00 pm

==Hmm, maybe paying bills on time is a good thing, who would have thunk it?==

Define on time. There is currently a backlog of $6.6 billion at the Comptroller’s Office. They are currently paying vouchers from November. Oh Susana used to remind us about this all the time under the prior administration. Not so much now.

Comment by Birds on the Bat Thursday, Feb 6, 20 @ 12:53 pm

== Define on time. There is currently a backlog of $6.6 billion at the Comptroller’s Office. They are currently paying vouchers from November.==

I guess when you are paying 3 month old bills instead of two year old bills and you only owe 6.6 billion instead of almost three times as much you calm down a bit.

https://illinoiscomptroller.gov/news/press-releases/comptroller-mendoza-uses-bond-proceeds-to-begin-paying-down-backlog-of-unpaid-bills/

Comment by 17% Solution Thursday, Feb 6, 20 @ 1:07 pm

== Define on time. There is currently a backlog of $6.6 billion at the Comptroller’s Office. They are currently paying vouchers from November. ==

On time definition - ‘… (the “Prompt Payment Act”), if a payment is not made to a vendor within 90 days of receipt of a proper invoice …’

In other words, Illinois is more or less current on paying most their bills. There is always a operational backlog of around $5B pending.

Comment by RNUG Thursday, Feb 6, 20 @ 1:38 pm

I guess there’s on time for the State and a different on time for the real world folks. I don’t get 90 days to pay my mortgage. Vendors can’t wait 90 days to pay their employees. It’s sad that a backlog of $5 billion is an acceptable norm in Illinois. That hasn’t always been the case. There was a time when we didn’t have a prompt payment act because we didn’t need it. Then when we needed it, it was 60 days. Now it’s 90 days. The legislature apparently can change the definition of on time as it sees fit. Opinions vary. Mine is different than others. Others are different than mine. And that’s ok.

Comment by Birds on the Bat Thursday, Feb 6, 20 @ 2:28 pm

==There is currently a backlog of $6.6 billion at the Comptroller’s Office.==

Don’t forget the $8 billion bond issued to pay down that backlog. Bills were paid, yet the bill remains.

Comment by City Zen Thursday, Feb 6, 20 @ 2:43 pm

At least some of these vendors finally got paid and are no longer unwilling lenders, and the taxpayers are now paying ~4% or less on that “remaining bill” instead of 12%. So there’s that.

Comment by Hieronymus Thursday, Feb 6, 20 @ 8:09 pm

==So there’s that.==

Yet the bill remains.

Comment by City Zen Friday, Feb 7, 20 @ 9:15 am

=== Yet the bill remains.===

I’ll look forward to your “Yes” vote on the progressive income tax.

Comment by Oswego Willy Friday, Feb 7, 20 @ 9:19 am